A TotalMoney home loan aims to help you save on interest and pay off your home loan faster using the balance of your everyday accounts. A mix of a flexible home loan and other loans gives the flexibility to access credit when needed for example for renovations while still making regular repayments to pay off lending. Home loan types nz.

Home Loan Types Nz, Loans for business or investment purposes excluded. Table Loans Interest Only Loans Reducing Home Loans Revolving Home Loans Offsetting Loans available from most Banks Greater than 80 LVR Loans Construction Loans Turn Key Construction Loans Table Loans Most people choose this type of mortgage. How it works -each repayment includes a. Although there are 7 and even 10 year terms available from some banks.

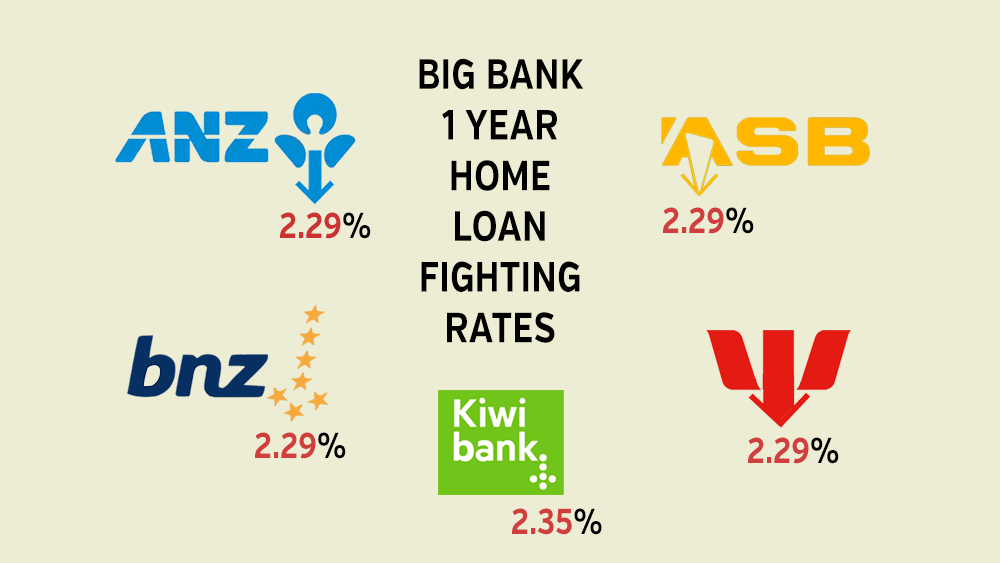

Bnz Cuts Mortgage Rates Now Too Quickly Followed By Asb Interest Co Nz From interest.co.nz

Bnz Cuts Mortgage Rates Now Too Quickly Followed By Asb Interest Co Nz From interest.co.nz

Our expert guide to home loans tells you everything you need to know to get a mortgage and save money. The idea is to help save on interest by reducing your daily loan balance as much as possible. Buy your first home with an ANZ Home Loan and you could get a 3000 cash contribution as long as you keep your home loan with ANZ for at least three years. Each week fortnight or month youll repay the same amount unless your interest rate changes.

Table Loans Interest Only Loans Reducing Home Loans Revolving Home Loans Offsetting Loans available from most Banks Greater than 80 LVR Loans Construction Loans Turn Key Construction Loans Table Loans Most people choose this type of mortgage.

Read another article:

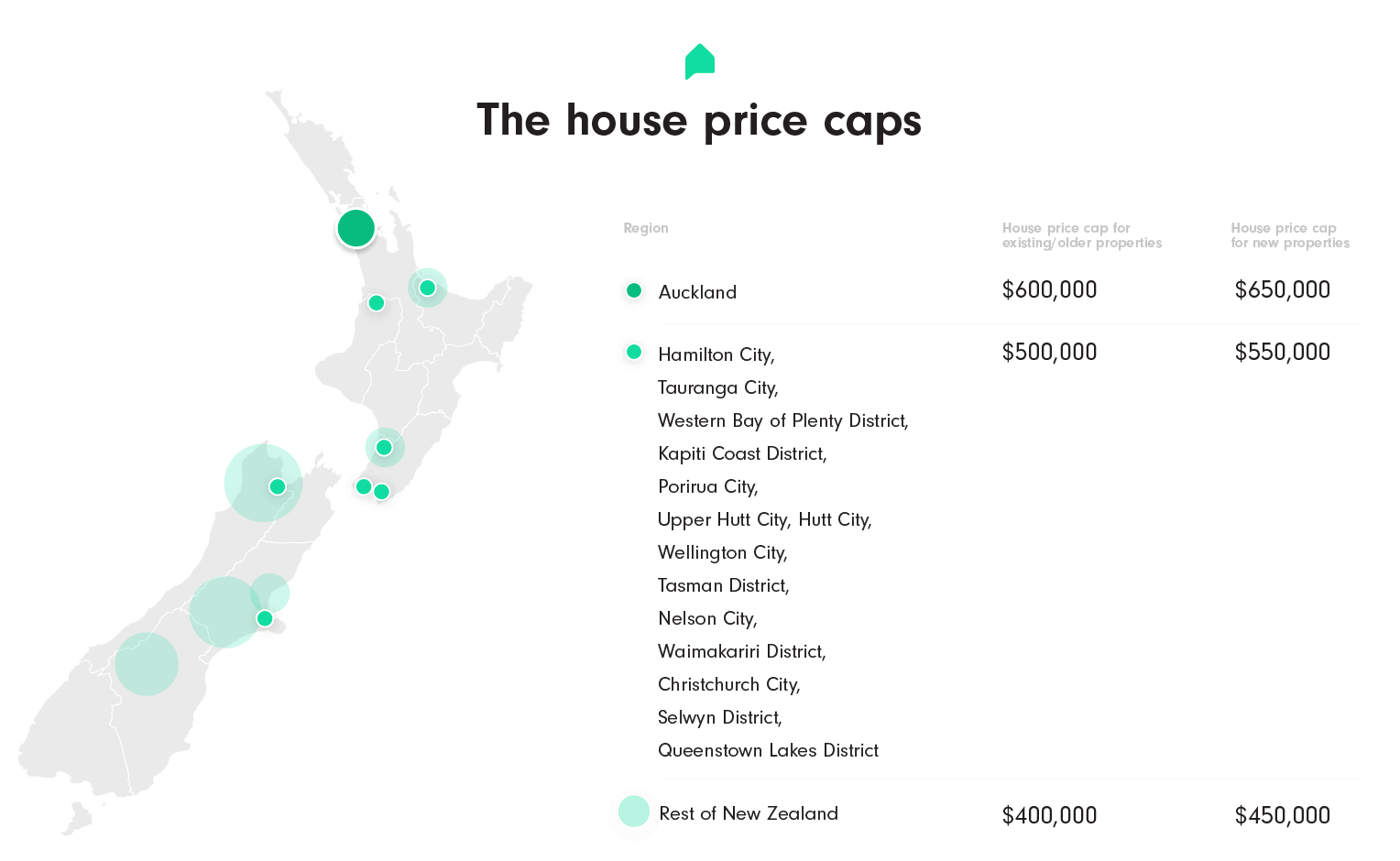

The government has a number of schemes to help New Zealand citizens and permanent residents buy their first home. Building a New Home. Have the flexibility to split your loan with a fixed home loan option. Home Loan product Interest rate type Loan term Direct salary payments. What are the different types of interest rates.

Detail Co-op Bank HSBC SBS Bank. Stay for at least 3 years. The government has a number of schemes to help New Zealand citizens and permanent residents buy their first home. An NZHL Sustainable Energy Loan can make it easier for you to get a solar small wind or mini hydro power system for your home. Should You Fix Your Mortgage For One Year Or More Newsroom.

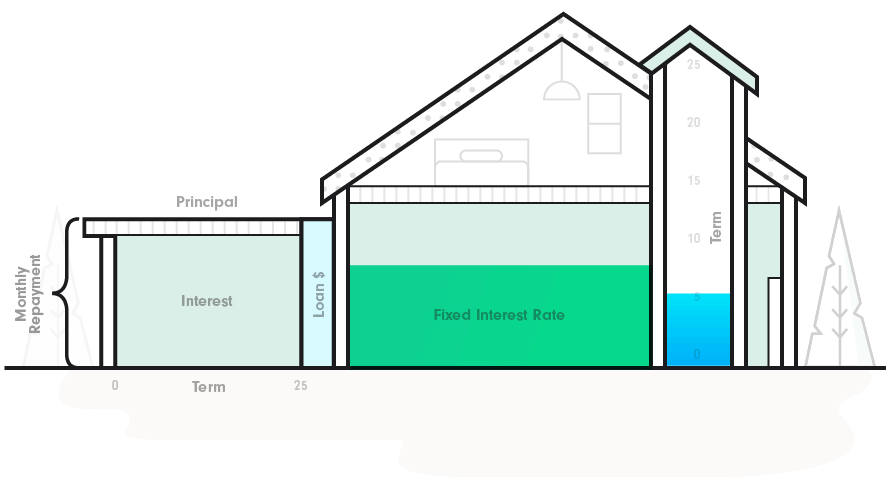

Source: opespartners.co.nz

Source: opespartners.co.nz

They work by depositing your salary and other income directly into your home loan account and then as you need money you withdraw it via. Calculations are based on the interest rates being constant for. Not available with any other Westpac home loan offers promotions or package discounts or the Westpac Choices Home Loan with Airpoints. Have the flexibility to split your loan with a fixed home loan option. How Do I Get A Mortgage And Pay It Off In 2022 Mortgage Opes.

Source: thefirsthomebuyersclub.co.nz

Source: thefirsthomebuyersclub.co.nz

Lending criteria terms conditions and fees apply to this offer 2. A revolving home loan such as Rapid Repay is sometimes called a line of credit or revolving credit mortgage. Once the final progress payment has been made and the loan has been fully drawn down it is usually converted to the loan type you require. Table loan This type of loan is the most popular in New Zealand. Home Loan Structure The First Home Buyers Club New Zealandthe First Home Buyers Club New Zealand.

Source: homeloan.co.nz

Source: homeloan.co.nz

Building a New Home. What are the different types of interest rates. No Proof of Income. Fees are similar to table loans. Compare The Top 10 Best Home Loans In Nz Homeloan Co Nz.

Source: opespartners.co.nz

Source: opespartners.co.nz

Your regular repayments are the same each week fortnight or month unless your interest rate changes. Reducing or straight line mortgages repay the same amount of principal with each repayment but a reducing amount of interest each time. These include the Welcome Home Loan FirstHome and KiwiSaver first home deposit subsidy and savings withdrawal schemes. Calculations are based on the interest rates being constant for. How Do I Get A Mortgage And Pay It Off In 2022 Mortgage Opes.

Source: opespartners.co.nz

Source: opespartners.co.nz

Variable set over floating rate On demand. Although there are 7 and even 10 year terms available from some banks. A Construction Loan is a specialised loan used to finance the building of a new home where the lender draws down funds commonly referred to as progress payments to the builder as certain stages of the home are completed. All-in-one home loans use your savings to reduce the interest charged on your home loan balance which in turn reduces the overall cost of your home loan. How Do I Get A Mortgage And Pay It Off In 2022 Mortgage Opes.

Source: homeloan.co.nz

Source: homeloan.co.nz

Up to 75 of the land value. 1000 2000 First Home Grant First Home Loan. Use our mortgage calculator to work out your costs. Loans for business or investment purposes excluded. Compare The Top 10 Best Home Loans In Nz Homeloan Co Nz.

Source: homeloan.co.nz

Source: homeloan.co.nz

First home buyers could get 3000 cash with ANZ. Each week fortnight or month youll repay the same amount unless your interest rate changes. A Construction Loan is a specialised loan used to finance the building of a new home where the lender draws down funds commonly referred to as progress payments to the builder as certain stages of the home are completed. Not available with any other Westpac home loan offers promotions or package discounts or the Westpac Choices Home Loan with Airpoints. Compare The Top 10 Best Home Loans In Nz Homeloan Co Nz.

Source: mortgages.co.nz

Source: mortgages.co.nz

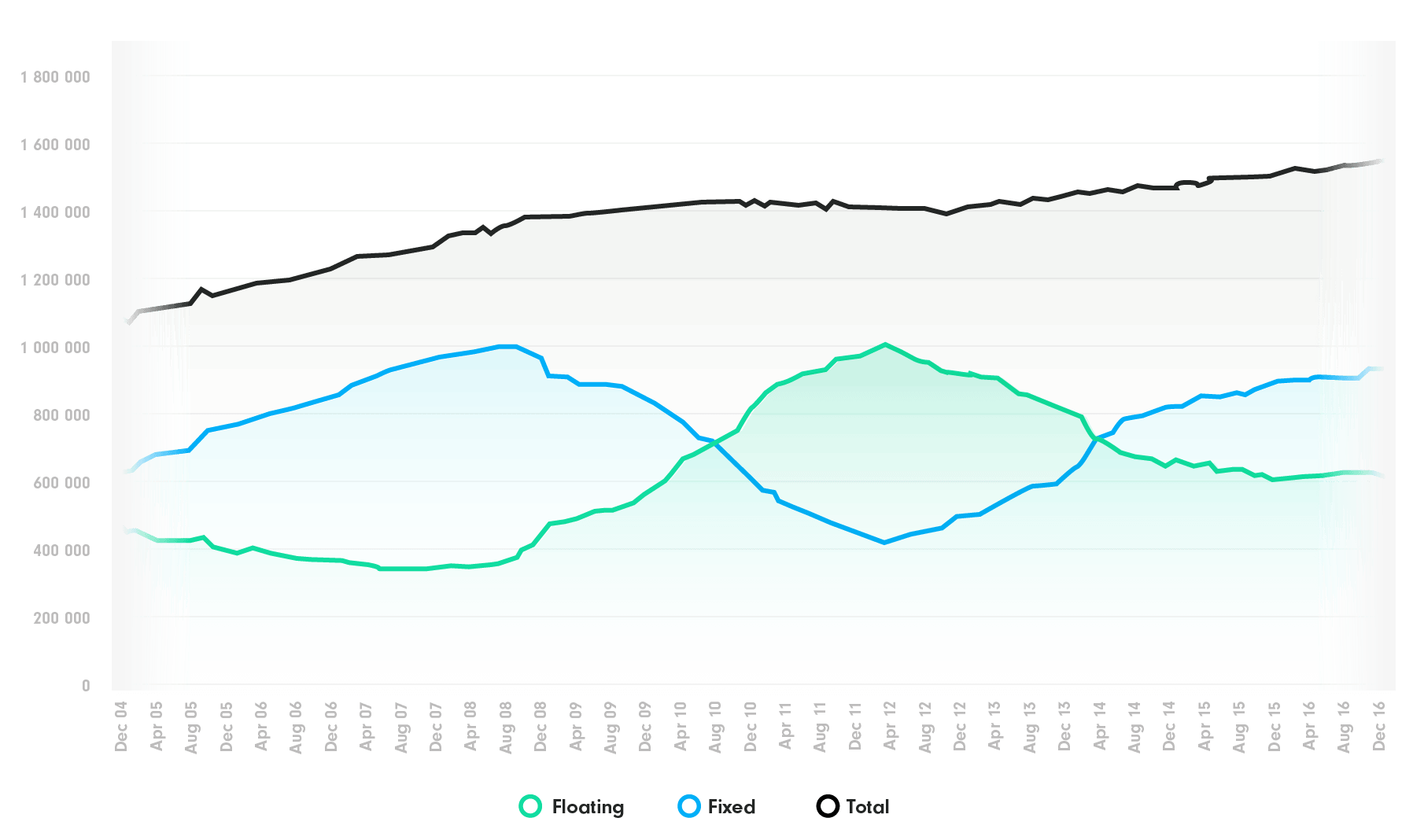

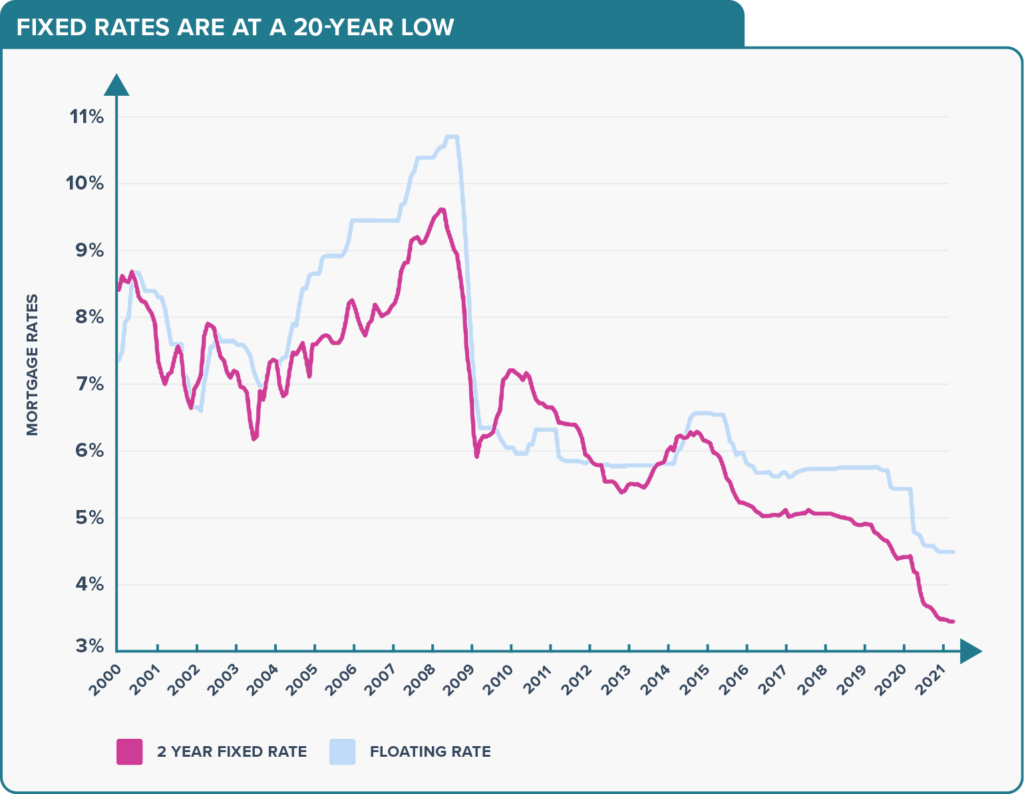

Loans for business or investment purposes excluded. A mix of different fixed rate periods or a mix of fixed rate and floating rate loans can help protect against interest rates moving. They work by depositing your salary and other income directly into your home loan account and then as you need money you withdraw it via. You can add it to a NZHL home loan to pay for an approved renewable energy system and well contribute up to 2000 towards the cost. How Long Should I Fix My Mortgage For Mortgages Co Nz.

Source: nzadvicegroup.co.nz

Source: nzadvicegroup.co.nz

Each repayment includes a portion of your interest and principal. Min 20 equity plus salary credit to a Westpac transaction account. This means the interest rate you pay on your loan is fixed for the term you agree to. A mix of a flexible home loan and other loans gives the flexibility to access credit when needed for example for renovations while still making regular repayments to pay off lending. Nz Advice Group The Rise And Fall Of Interest Rates.

Source: stuff.co.nz

Source: stuff.co.nz

Up to 90 of your homes current value. Depending on the amount you want to borrow you may need to get valuations at different stages of. The most common type of home loan is a table loan. What are the different types of interest rates. Don T Panic Over Home Loan Rate Rises Mortgage Brokers Say Stuff Co Nz.

Source: jarden.co.nz

Source: jarden.co.nz

Lending criteria terms conditions and fees apply to this offer 2. Depending on the amount you want to borrow you may need to get valuations at different stages of. Reducing or straight line mortgages repay the same amount of principal with each repayment but a reducing amount of interest each time. Stay for at least 3 years. The Ups And Downs Of The Mortgage Market Jarden.

Source: thefirsthomebuyersclub.co.nz

Source: thefirsthomebuyersclub.co.nz

The most common type of home loan is a table loan. A mix of different fixed rate periods or a mix of fixed rate and floating rate loans can help protect against interest rates moving. This loan looks at the combined balances of your TotalMoney everyday accounts and subtracts these from the balance of your TotalMoney home loan 4 so you only pay interest on the remaining amount. All-in-one home loans use your savings to reduce the interest charged on your home loan balance which in turn reduces the overall cost of your home loan. Home Loan Structure The First Home Buyers Club New Zealandthe First Home Buyers Club New Zealand.

Source: teara.govt.nz

Source: teara.govt.nz

You can add it to a NZHL home loan to pay for an approved renewable energy system and well contribute up to 2000 towards the cost. Your regular repayments are the same each week fortnight or month unless your interest rate changes. Also known as a home equity loan all-in-one loans are a combination home loan and daily transaction account in one. Building a New Home. Interest Rates 1966 2008 Prices And Inflation Te Ara Encyclopedia Of New Zealand.

Source: moneyhub.co.nz

Source: moneyhub.co.nz

Fees are similar to table loans. Up to 90 of your homes current value. Split or Combination Loan. Buy your first home with an ANZ Home Loan and you could get a 3000 cash contribution as long as you keep your home loan with ANZ for at least three years. Low Deposit Home Loans Moneyhub Nz.