Low. The majority of bridging lenders charge an arrangement fee which can range from 1 - 2 and will depend on the loan size. Home equity loan interest rates uk.

Home Equity Loan Interest Rates Uk, Rates vary based on the size of the loan as well as the selected term. This was good news for first-time home buyers and those. Average interest rates on lifetime mortgages are currently around 4 with the cheapest rates nearer to 3. For the 2 Year Fixed Premier Standard at LTV 80 for first home buyers Follow.

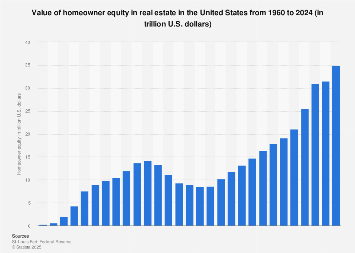

Value Of U S Homeowner Equity 2020 Statista From statista.com

Value Of U S Homeowner Equity 2020 Statista From statista.com

If you had paid off your mortgage in full the equity would be 150000. To get a personalised quotation simply click Get a quote and your local Equity Release Supermarket adviser will be happy to help you. The majority of bridging lenders charge an arrangement fee which can range from 1 - 2 and will depend on the loan size. And you can get quotes from equity release advisers who could give you expert equity release advice.

Equity Choice - Home Equity Line of Credit - Interest Only Community Improvement Loan Effective February 8 2021.

Read another article:

You may decide to do this to fund home improvements for example. For example if you have 50000 equity in your current home and want to buy a new house for 200000 you would have a 25 deposit. See average home equity loan rates from national and regional lenders. Average interest rates on lifetime mortgages are currently around 4 with the cheapest rates nearer to 3. Adverse credit - CCJs defaults arrears - we consider them all.

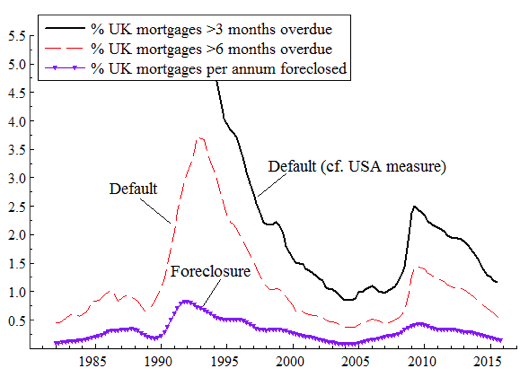

Source: voxeu.org

Source: voxeu.org

The amount you can borrow term and interest rate depend on property equity credit history and personal circumstances. If you took out a 50000 home equity loan at a fixed interest rate of 5 you would pay 20833 per month on an interest only basis. Loans for any purpose. The equity in your home is the difference between the saleable value of the property and the borrowing you have against it. Mortgage Delinquency And Foreclosure In The Uk Vox Cepr Policy Portal.

Source: voxeu.org

Source: voxeu.org

If interest rates went up to 8 you would continue to pay 20833 per month rather than someone on a variable rate that would pay 33333 for the same interest only loan at 8 per cent. Loans for any purpose. If you click check eligibility you can also see if youre suitable for the loan. The lowest Equity Release interest rate is currently 297 AER fixed for life. Mortgage Delinquency And Foreclosure In The Uk Vox Cepr Policy Portal.

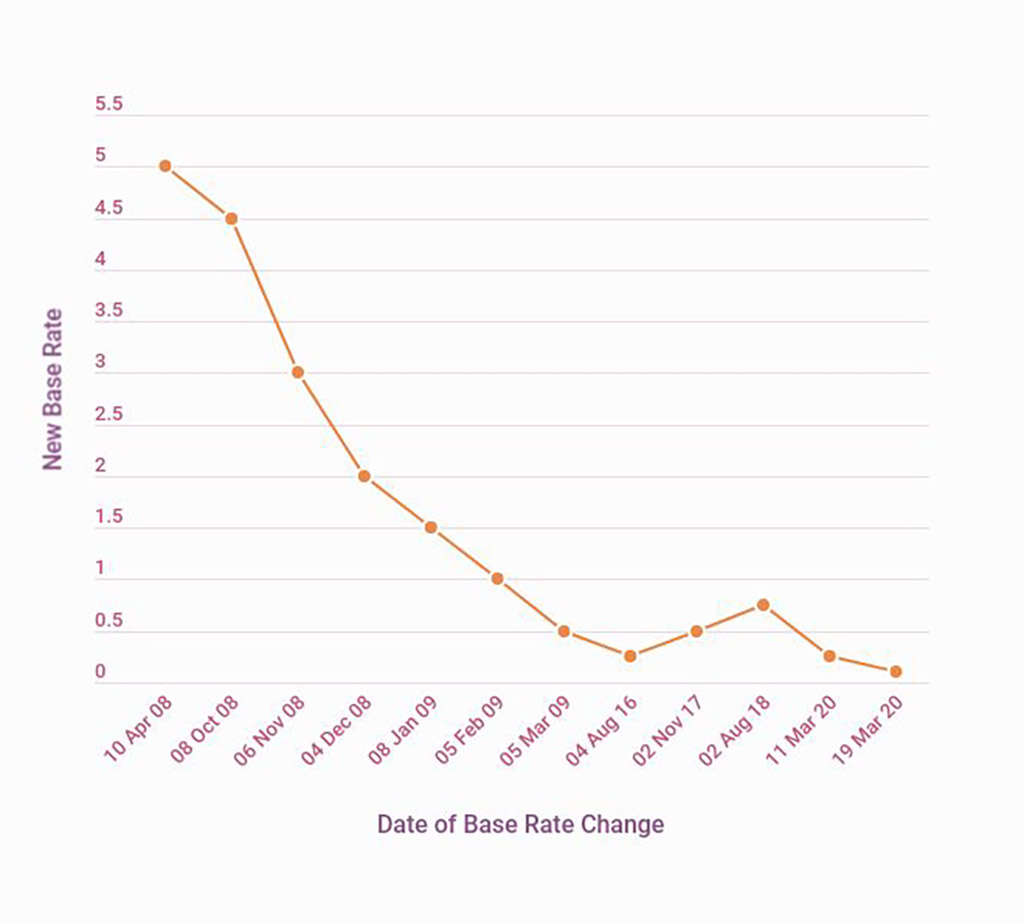

Source: telegraph.co.uk

Source: telegraph.co.uk

TD Bank Best for 10-year loans. Equity release interest rates and charges. HSBC UK 2 Year Fixed Mortgage. This is the lowest rates have been for a number of years yet note that theyre still significantly higher than those for most standard mortgages. Equity Release Calculator The Telegraph.

Source: pinterest.com

Source: pinterest.com

This was good news for first-time home buyers and those. Based on an annually rolled up lifetime mortgage loan of 50000 with a compound interest rate of 4. The amount you can borrow term and interest rate depend on property equity credit history and personal circumstances. Once youve found your plan use the More info button to learn all about the scheme youre interested in. Personal Business Loans Ways To Get The Lowest Rate On Your Home Equity Lo Homeimprovementmortgage Home Equity Home Equity Loan Home Improvement Loans.

Source: statista.com

Source: statista.com

This means you can look for 75 LTV mortgages which are usually cheaper than mortgages with a higher LTV. Interest rates start from 048 per month and depend on a number of factors including the nature of the security property what the funds are being used for and the overall loan to value. HSBC UK 2 Year Fixed Mortgage. For example if you have 50000 equity in your current home and want to buy a new house for 200000 you would have a 25 deposit. Value Of U S Homeowner Equity 2020 Statista.

Source: pinterest.com

Source: pinterest.com

Longer term loans might attract lower interest rates but be sure to take into account the overall cost as youll be paying back the loan amount for longer. Equity Choice - Home Equity Line of Credit - Interest Only Community Improvement Loan Effective February 8 2021. Low. The majority of bridging lenders charge an arrangement fee which can range from 1 - 2 and will depend on the loan size. Interest Only Mortgage Deals Interest Only Mortgage Payday Loans Mortgage Lenders.

Source: bankrate.com

Source: bankrate.com

If interest rates went up to 8 you would continue to pay 20833 per month rather than someone on a variable rate that would pay 33333 for the same interest only loan at 8 per cent. The current interest rates on home equity loans will vary between lenders and will also be based on your loan to value ratio personal finances and credit score. The amount you can borrow term and interest rate depend on property equity credit history and personal circumstances. A home loan is a type of secured loan. Td Bank 2021 Home Equity Review Bankrate.

Source: in.pinterest.com

Source: in.pinterest.com

The amount you can borrow term and interest rate depend on property equity credit history and personal circumstances. See average home equity loan rates from national and regional lenders. When this rate expires it will revert to the HSBC variable rate. Low. Home Loan Mortgage Payment Fha Loans Current Mortgage Rates.

Source: money.co.uk

Source: money.co.uk

Equity Choice - Home Equity Line of Credit - Interest Only Community Improvement Loan Effective February 8 2021. These loan rates are limited to loans for repairs or improvements mandated by a Municipality Borough or County. Self employed - its fine. For example if you have 50000 equity in your current home and want to buy a new house for 200000 you would have a 25 deposit. Bank Of England Base Rate Money Co Uk.

Source: keepmoat.com

Source: keepmoat.com

Loans for any purpose. It enables you to borrow money against the equity in your home. TD Bank offers home equity loans in 5 10 15 20 and 30-year increments. For example if your home is currently valued at 150000 and you have 50000 outstanding on your mortgage the equity in your home would be 100000. Help To Buy England And Wales Help To Buy Equity Loan Keepmoat.

Source: theguardian.com

Source: theguardian.com

The highest interest rate in the market is 680 AER. Homeowner loans are typically repaid over five-to-25 years and are for over 15000 but such figures are not definitive. To get a personalised quotation simply click Get a quote and your local Equity Release Supermarket adviser will be happy to help you. Equity release interest rates and charges. Everyone Is On Edge Mortgage Prisoners Fear Uk Interest Rate Rise Mortgages The Guardian.

Source: forbes.com

Source: forbes.com

No obligation free quotes. Compare interest rates on equity release and maximum LTV to find the best equity release deals. A home loan could be an additional element to your existing mortgage if you have one or be your only form of secured borrowing. In March 2020 the 10-year fixed mortgage rate was at its lowest at 236 percent. Best Home Equity Loan Lenders Of December 2021 Forbes Advisor.

Source:

Source:

If you click check eligibility you can also see if youre suitable for the loan. Adverse credit - CCJs defaults arrears - we consider them all. And you can get quotes from equity release advisers who could give you expert equity release advice. Rate indicated is the initial interest 2 year interest rate. Wg5d8oxlmms8um.

Source: pinterest.com

Source: pinterest.com

This is the lowest rates have been for a number of years yet note that theyre still significantly higher than those for most standard mortgages. This means you can look for 75 LTV mortgages which are usually cheaper than mortgages with a higher LTV. TD Bank offers home equity loans in 5 10 15 20 and 30-year increments. Rate indicated is the initial interest 2 year interest rate. Home Equity Loan Process Home Equity Loan Home Equity Underwriting.

Source: anwylhomes.co.uk

Source: anwylhomes.co.uk

Equity release interest rates and charges. Compare equity release interest rates and deals. While rates typically go higher as you move into longer-term loans TD Banks 10 15 and 20-year loans carry lower rates than the shorter 5-year option. A home equity loan allows homeowners to borrow against their homes value. Equity Loan Mortgage Calculator.