Security of a fixed interest rate. Accommodating repayment terms that work uniquely for you. Home equity loan interest rates mt bank.

Home Equity Loan Interest Rates Mt Bank, Fixed Home Equity Loan rates range from 4125 to 1800 APR. 3 This is a variable rate home equity line of credit not to exceed 18 APR. Rate as low as 699 APREAIR Home Equity. Lines greater than 500000 up to 1000000 subject to 7599 maximum combined loan-to-value.

Myfico Loan Center Your Trusted Source For Home Equity Line Of Credit Home Loans Refinance Compare Interest Rates Online In Minutes From myfico.com

Myfico Loan Center Your Trusted Source For Home Equity Line Of Credit Home Loans Refinance Compare Interest Rates Online In Minutes From myfico.com

The initial amount funded at origination will be based on. Rates are based on creditworthiness. Bankrate has offers for Montana mortgage and. Maximum rate 18.

The full loan amount upfront.

Read another article:

The full loan amount upfront. Rate as low as 1649 APREAIR Cash Secured. Security of a fixed interest rate. 1 an auto pay discount of 025 for setting up automatic payment at or prior to HELOC account opening and maintaining such automatic payments from an eligible Bank of America deposit account. FIXED rates from 300 APR.

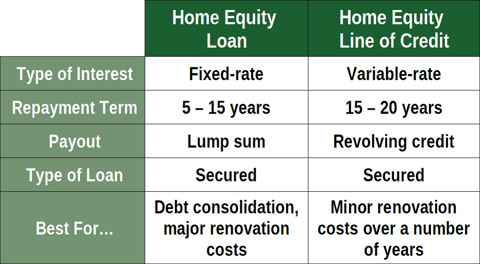

Source: badcredit.org

Source: badcredit.org

Security of a fixed interest rate. The initial amount funded at origination will be based on. A HELOC typically has a lower interest rate than some other common types of loans and the interest may be tax deductible. TD Bank Best for 10-year loans. 3 Home Equity Loans For Bad Credit 2021 Badcredit Org.

Source: credible.com

Source: credible.com

TD Bank offers home equity loans in 5 10 15 20 and 30-year increments. The rate for a home equity line of credit is 295 for the first nine months after closing with auto debit from an Investors Bank checking account. Because they are secured they can have repayment terms of up to. Combined with all other property liens. Refinancing A Home Equity Loan What You Need To Know Credible.

It features 100 financing on loans that are used to purchase a home. A home equity loan is a lump-sum loan thats secured by the equity in your home. 3 This is a variable rate home equity line of credit not to exceed 18 APR. 2 an initial draw discount of 005 for every 10000 initially withdrawn at account opening up to 075. 2.

Source: money.com

Source: money.com

Select an account type from the list below. Combined with all other property liens. Monthly Fixed-Rate Loans Payment Examples. The variable rate is based on Wall Street Journal Prime WSJP Rate plus 075 currently 400 APR as of 03162020. 7 Best Home Equity Loans Of 2021 Money.

Source: interiorfcu.org

Source: interiorfcu.org

The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount. Fixed-Rate Loan Option at account opening. Interest rate APR and origination fee on a 15-year loan for a primary residence or second home. The initial amount funded at origination will be based on. Home Equity Loans Interior Federal Credit Union.

Source: myfico.com

Source: myfico.com

View and compare todays interest rates and fees for MT Bank products. Revolving line of credit or closed end. Interest Only Home Equity Line of Credit. Rates are based on creditworthiness. Myfico Loan Center Your Trusted Source For Home Equity Line Of Credit Home Loans Refinance Compare Interest Rates Online In Minutes.

You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate. A home equity loan is a lump-sum loan thats secured by the equity in your home. The New Fairy Godmother. Fixed-Rate Loan Option at account opening. Tips To Help Financial Marketers Get More Home Equity Lending Business.

Source: interiorfcu.org

Source: interiorfcu.org

The existing equity in your home is used as collateral backing. TD Bank Best for 10-year loans. Monthly payments can be deducted automatically from your CNB Bank checking account at a reduced interest rate saving you time and money and making payments easy. Maximum rate 18. Home Equity Loans Interior Federal Credit Union.

Source: southstatebank.com

Source: southstatebank.com

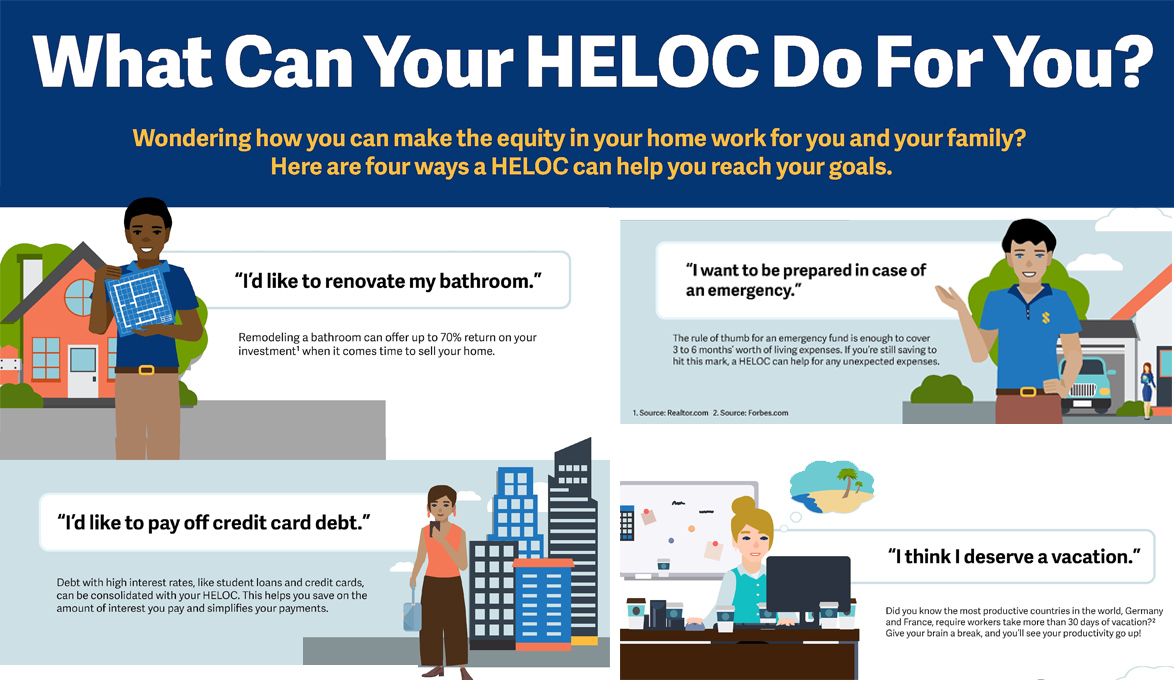

The full loan amount upfront. You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate. Rate offered subject to change monthly. 3 This is a variable rate home equity line of credit not to exceed 18 APR. What Can Your Heloc Home Equity Line Of Credit Do For You Southstate Bank.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

Accommodating repayment terms that work uniquely for you. At Mountain Valley Bank we are proud to offer loans to the VA. Term Years Amount Borrowed Monthly Payment Total Loan Interest 80 LTV 1st Lien 4. As of March 5 2020 Prime Rate is 325 and APR is 325. Home Equity Line Of Credit Qualification Calculator.

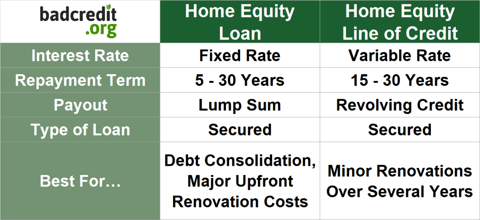

Source: badcredit.org

Source: badcredit.org

Lines 15000 to 500000 subject to 8599 maximum combined loan-to-value. Accommodating repayment terms that work uniquely for you. Combined with all other property liens. 1 an auto pay discount of 025 for setting up automatic payment at or prior to HELOC account opening and maintaining such automatic payments from an eligible Bank of America deposit account. 4 Subprime Home Equity Loans 2021 Badcredit Org.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

MT CHOICEquity accounts cannot be used to pay off existing MT CHOICEquity or Home Equity accounts. The Figure Home Equity Line is an open-end product where the full loan amount minus the origination fee will be 100 drawn at the time of origination. The Annual Percentage Rate APR is a variable rate and is based on the Wall Street Journals Prime Rate plus 50. Rate as low as 1649 APREAIR Cash Secured. 5 Year Fixed Mortgage Rates And Loan Programs.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

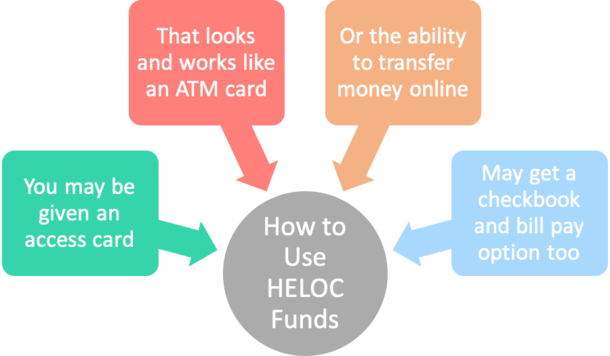

Interest rate APR and origination fee on a 15-year loan for a primary residence or second home. Rate offered subject to change monthly. Maximum rate 18. Monthly payments can be deducted automatically from your CNB Bank checking account at a reduced interest rate saving you time and money and making payments easy. How A Heloc Works Tap Your Home Equity For Cash.

Source: lakecitybank.com

Source: lakecitybank.com

View and compare todays interest rates and fees for MT Bank products. Your rate may change. Funding as fast as 5 days. Maximum rate 18. 2 99 Apr Heloc Special Personal Banking Lake City Bank.

Source: ml.com

Source: ml.com

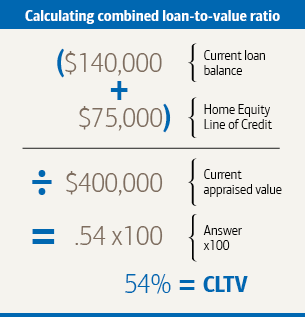

Funding as fast as 5 days. Rates vary based on the size of the loan as well as the selected term. A home equity line of credit also known as a HELOC is a line of credit secured by your home that gives you a revolving credit line that you can use for large expenses or to consolidate higher-interest rate debt. A Home Equity Loan or Line of Credit can be used for almost any major expense including. How To Calculate Your Home S Equity Loan To Value Ltv Tips.