Beneficiaries in general are people or entities that the holder of an account designates to receive the assets in the account typically in the event of the account holders death. If however you do not sign a designation document then. Bank account beneficiary designation.

Bank Account Beneficiary Designation, TOD accounts like a 401k IRA or bank account will transfer ownership to your beneficiary and they will take over management How to make a beneficiary designation In order for an asset to pass to the named beneficiary you must complete the proper paperwork a beneficiary designation form typically provided by the plan administrator or insurance company. Beneficiaries can include spouses children and other relatives. Bank Accounts with You as the Sole Owner. To designate beneficiaries you will need the full legal name of the individual.

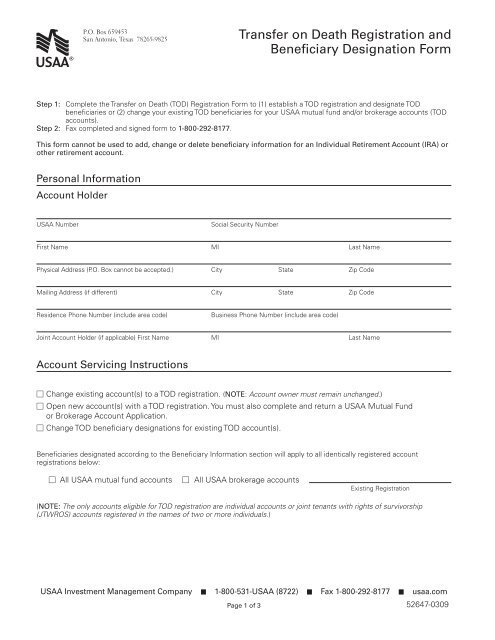

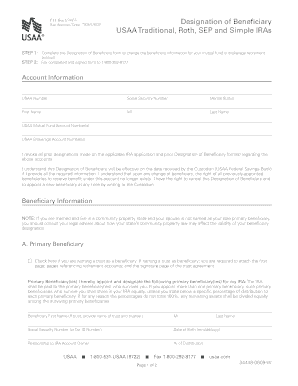

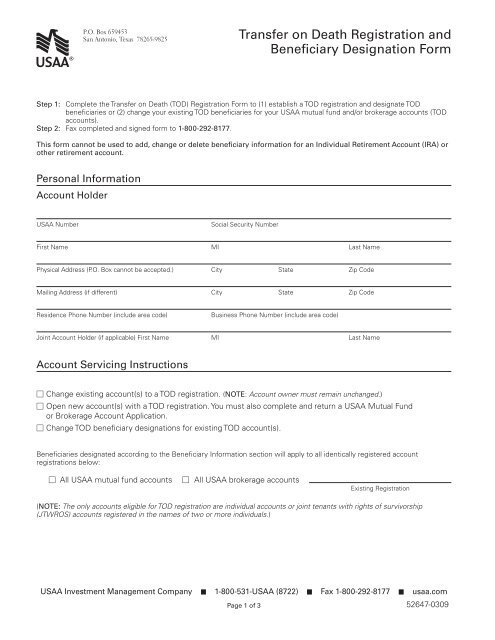

Transfer On Death Registration And Beneficiary Designation Usaa From yumpu.com

Transfer On Death Registration And Beneficiary Designation Usaa From yumpu.com

Accounts with named payable on death beneficiaries can be accessed when the named beneficiary provides the bank with a certified copy of the death certificate and proper identification. Which Should I Set Up - A Bank Account Beneficiary or a Will Beneficiary. It can be used to liquidate and pay the balance of a bank account or certificate of deposit to a named beneficiary in the event of the account holders death. Beneficiary designations are commonly used with life insurance policies IRAs 401ks and other types of accounts with death benefits.

And dont worry as long as youre living your beneficiary doesnt have access to your account unless youve set them up as a cosigner.

Read another article:

A will is a very important part of your estate plan but its not the only tool in your estate planning toolbox explains the article Protecting Your Assets. Account designation is a term used when talking about a beneficiary of a bank account. To designate beneficiaries you will need the full legal name of the individual. And dont worry as long as youre living your beneficiary doesnt have access to your account unless youve set them up as a cosigner. Beneficiaries can include spouses children and other relatives.

Source: pinterest.com

Source: pinterest.com

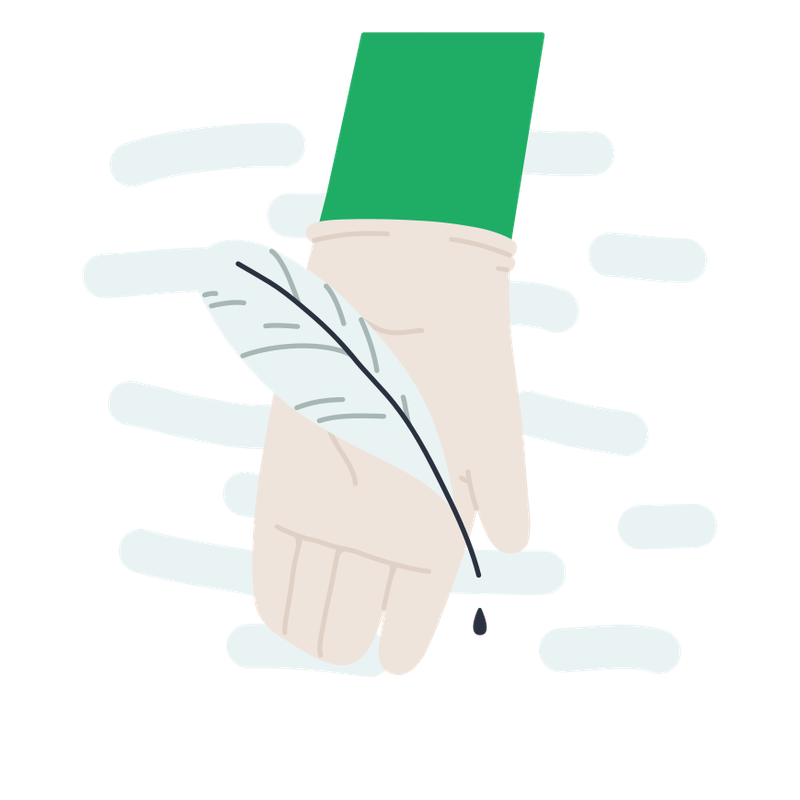

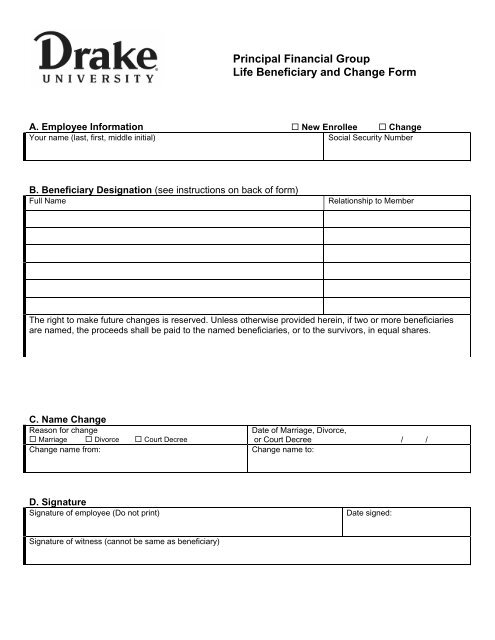

Each can be transferred to your heirs by beneficiary designation. A beneficiary designation is a legally binding directive that allows the owner of a financial asset to designate who receives the. How to Designate a Beneficiary on your Savings Account The designation of beneficiaries must be done through the financial institutions beneficiary form. The persons designated as beneficiaries may differ from those who receive under the will. Product Request Form Template In 2021 Form Templates Request.

Source: pdffiller.com

Source: pdffiller.com

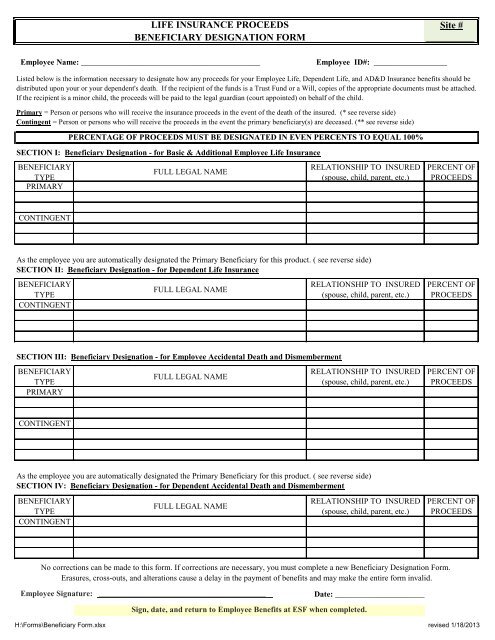

Account designation is a term used when talking about a beneficiary of a bank account. The completed form gives the bank authorization to convert the. A will is a very important part of your estate plan but its not the only tool in your estate planning toolbox explains the article Protecting Your Assets. That is because the will goes through probate wills control assets that are in your name only and lastly if. Beneficiary Designation Form Fill Online Printable Fillable Blank Pdffiller.

Source: due.com

Source: due.com

Bank accounts securities accounts retirement accounts IRAs 401ks life insurance policies and other financial assets share one commonality. You will also need to determine what percentage of your assets will go to each beneficiary if you have more than one listed. Accounts with named payable on death beneficiaries can be accessed when the named beneficiary provides the bank with a certified copy of the death certificate and proper identification. Joint Accounts and Beneficiary Designations from The Street. 10 Beneficiary Designation Mistakes To Avoid Due.

Source: yumpu.com

Source: yumpu.com

A payable-on-death POD designation is a form of beneficiary designation. Accounts with named payable on death beneficiaries can be accessed when the named beneficiary provides the bank with a certified copy of the death certificate and proper identification. Generally speaking the purpose of a beneficiary designation is to indicate who will receive an account upon the death of the account owner. How to Designate a Beneficiary on your Savings Account The designation of beneficiaries must be done through the financial institutions beneficiary form. Beneficiary Form.

Source: pdffiller.com

Source: pdffiller.com

A bank account beneficiary designation can pass the contents of a bank account separately from the rest of that persons estate. You cannot name a beneficiary or successor holderannuitant on non-registered accounts. The completed form gives the bank authorization to convert the. It can be used to liquidate and pay the balance of a bank account or certificate of deposit to a named beneficiary in the event of the account holders death. Usaa Beneficiary Designation Form Fill Online Printable Fillable Blank Pdffiller.

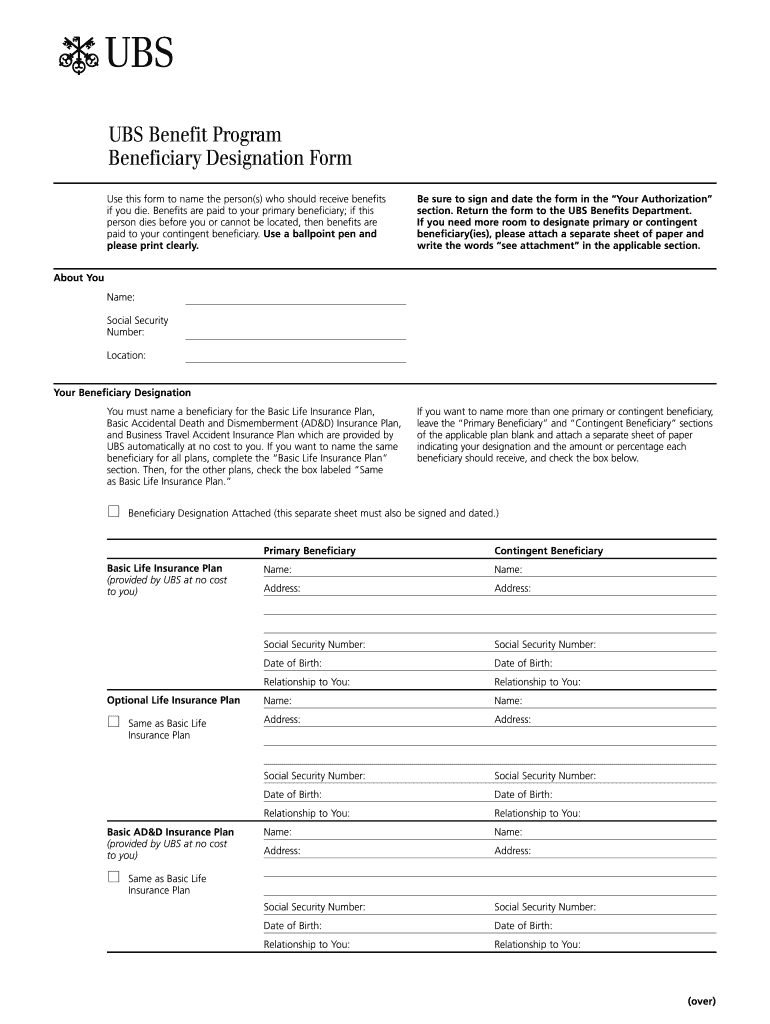

Source: ubs-beneficiary-designation-form.pdffiller.com

Source: ubs-beneficiary-designation-form.pdffiller.com

TOD accounts like a 401k IRA or bank account will transfer ownership to your beneficiary and they will take over management How to make a beneficiary designation In order for an asset to pass to the named beneficiary you must complete the proper paperwork a beneficiary designation form typically provided by the plan administrator or insurance company. You will also need to determine what percentage of your assets will go to each beneficiary if you have more than one listed. Bank accounts securities accounts retirement accounts IRAs 401ks life insurance policies and other financial assets share one commonality. A will is a very important part of your estate plan but its not the only tool in your estate planning toolbox explains the article Protecting Your Assets. Ubs Forms Fill Online Printable Fillable Blank Pdffiller.

Source: jhinvestments.com

Source: jhinvestments.com

Jointly Owned Accounts If you own an account jointly with someone else then after one of you dies in most cases the surviving co-owner will automatically become the accounts sole owner. When an individual with a bank account dies the account designation is the form that states to whom the account is given. If however you do not sign a designation document then. The person designated to receive the funds after the account holders death is called a beneficiary. Beneficiary Designation Form John Hancock Investment Mgmt.

Source: forbes.com

Source: forbes.com

You can have more than one beneficiary and this information can be updated on your account at any time. Beneficiaries in general are people or entities that the holder of an account designates to receive the assets in the account typically in the event of the account holders death. A bank account beneficiary designation can pass the contents of a bank account separately from the rest of that persons estate. Joint Accounts and Beneficiary Designations from The Street. Do You Need A Beneficiary For Your Bank Account Forbes Advisor.

Source: yumpu.com

Source: yumpu.com

Which Should I Set Up - A Bank Account Beneficiary or a Will Beneficiary. As the name implies it allows a person to designate beneficiaries for their financial accounts retirement account life. How to Use Joint Accounts and Beneficiary Designations. If however you do not sign a designation document then. Life Insurance Beneficiary Form.

Source: pinterest.com

Source: pinterest.com

You cannot name a beneficiary or successor holderannuitant on non-registered accounts. If you own a bank account that is in your name only you might have had the option to sign a document designating a beneficiary for your account upon death. What is beneficiary designation. When you add a beneficiary to your account your bank leaves the account in your name but adds the term payable upon death followed by the names of the beneficiaries. Pin On Computer.

Source: pinterest.com

Source: pinterest.com

A beneficiary designation however is different. If however you do not sign a designation document then. Information regarding beneficiaries name address social security number etc to an account is usually requested for during the initial account opening. Federal banking regulations allow a bank account holder to designate another person to receive the balance of the account in the event of his death. How To Designate Your Ira Beneficiary Infographic Inside Your Ira Ira Investing For Retirement Roth Ira Investing.

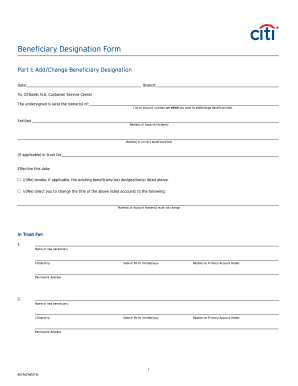

Source: pdffiller.com

Source: pdffiller.com

Beneficiary designations most often supersede all outside Estate Plans and agreements including divorce and prenuptial agreements. You can have more than one beneficiary and this information can be updated on your account at any time. A will is a very important part of your estate plan but its not the only tool in your estate planning toolbox explains the article Protecting Your Assets. And dont worry as long as youre living your beneficiary doesnt have access to your account unless youve set them up as a cosigner. Citibank Transfer On Death Form Fill Online Printable Fillable Blank Pdffiller.

Source: pdffiller.com

Source: pdffiller.com

The bank in turn gives you as the owner of the account a beneficiary designation form called a Totten trust to fill out. You cannot name a beneficiary or successor holderannuitant on non-registered accounts. Instead of sharing the account with another account holder setting up a this kind of designation is a form of estate planning that allows an account holder to leave a bank accounts contents to a loved one or organization upon their death. If however you do not sign a designation document then. Manulife Beneficiary Designation Form Fill Online Printable Fillable Blank Pdffiller.

Source: info.legalzoom.com

Source: info.legalzoom.com

Beneficiary designations most often supersede all outside Estate Plans and agreements including divorce and prenuptial agreements. Bank Accounts with You as the Sole Owner. A bank account beneficiary designation can pass the contents of a bank account separately from the rest of that persons estate. Beneficiary designations are commonly used with life insurance policies IRAs 401ks and other types of accounts with death benefits. What Is The Law For Beneficiary Designation For Bank Accounts Legalzoom Com.

Source: yumpu.com

Source: yumpu.com

Account designation is a term used when talking about a beneficiary of a bank account. Examples of beneficiary designation assets include IRAs company-sponsored retirement plans life insurance policies annuities college savings accounts health savings accounts or. When you add a beneficiary to your account your bank leaves the account in your name but adds the term payable upon death followed by the names of the beneficiaries. Beneficiary designations are commonly used with life insurance policies IRAs 401ks and other types of accounts with death benefits. Transfer On Death Registration And Beneficiary Designation Usaa.