Banks do not loan out all of excess their reserves. Monetary policy involves setting the interest rate on overnight loans in the money market the cash rate. A tight money policy that is designed to decrease inflation.

A Tight Money Policy That Is Designed To Decrease Inflation, Under the Policy Targets Agreement PTA the Reserve Bank is required to keep future CPI inflation outcomes between one percent and three percent on average over the medium term although it is acknowledged that isolated price movements can justify outcomes outside. People can hold any loaned money as cash. During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. Banks loan out all of their excess reserves.

Reading Monetary Policy And Aggregate Demand Macroeconomics From courses.lumenlearning.com

Reading Monetary Policy And Aggregate Demand Macroeconomics From courses.lumenlearning.com

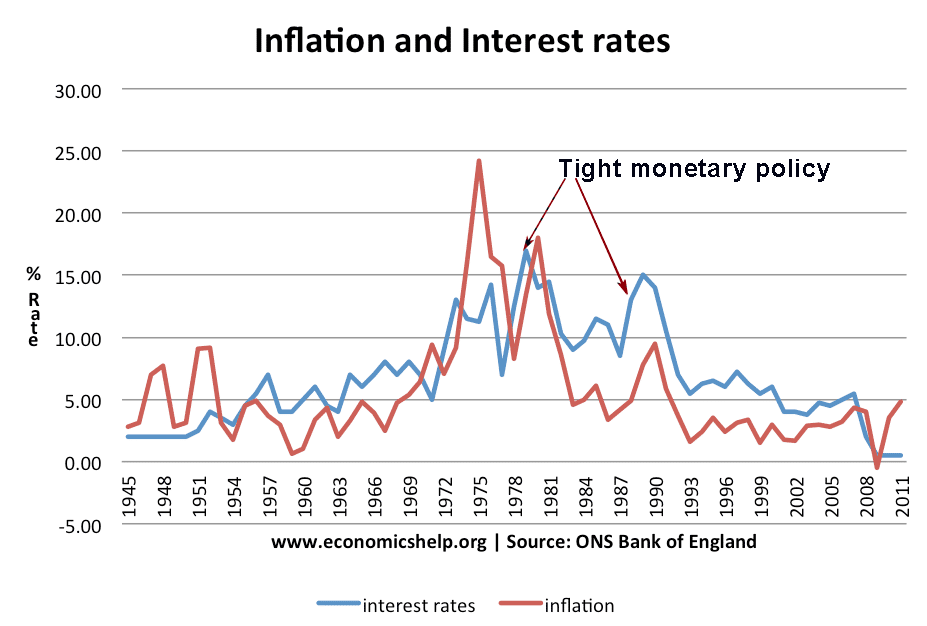

Its aim is to reduce the pressure caused by high inflation and to cool the economy. A contractionary monetary policy also called a tight monetary policy reduces the quantity of money and credit below what it otherwise would have been and raises interest rates seeking to hold down inflation. Monetary policy affects how much prices are rising called the rate of inflation. Japans ineffective easy money policy illustrates the potential inability of monetary policy to bring an economy out of recession.

We also support the Governments other economic aims for growth and employment.

Read another article:

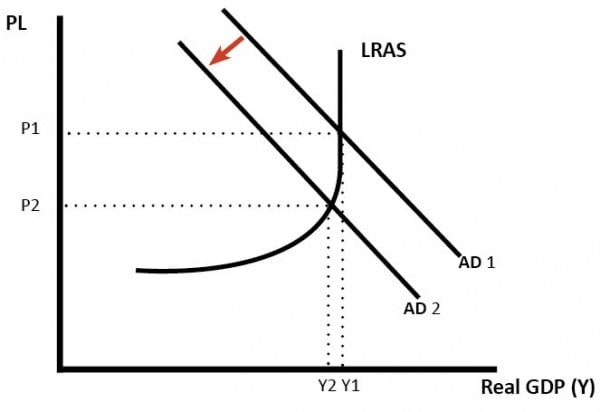

The effect of lower unemployment on inflation mirrors the effect of high employment on labor and product markets. When the government pursued a tight money policy during the Great Depression it caused aggregate demand to decrease because it. Under the Policy Targets Agreement PTA the Reserve Bank is required to keep future CPI inflation outcomes between one percent and three percent on average over the medium term although it is acknowledged that isolated price movements can justify outcomes outside. It is used to overcome an inflationary gap. In the real world the actual money multiplier tends to be smaller than 1rr because.

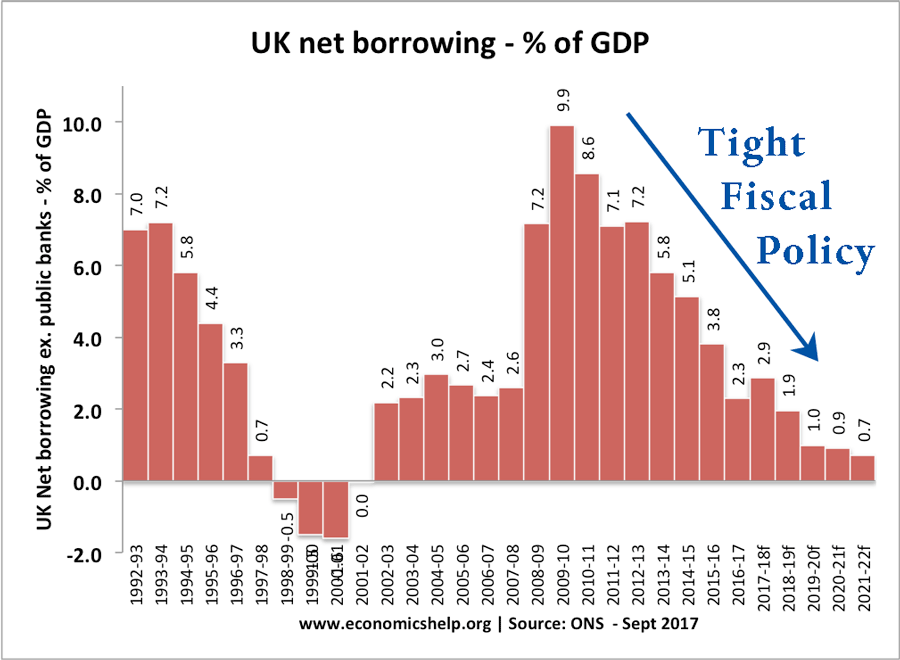

Its aim is to reduce the pressure caused by high inflation and to cool the economy. During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. We set monetary policy to achieve the Governments target of keeping inflation at 2. When the government employs a tight fiscal policy we should expect that A the level of output will only be affected by a small amount B interest rates will increase C monetary policy will be easy at the same time D inflation will be lowered more than unemployment E the budget deficit will decrease. Understanding Supply Side Economics.

Source: economicshelp.org

Source: economicshelp.org

We set monetary policy to achieve the Governments target of keeping inflation at 2. The Federal Reserve uses three. Contractionary monetary policy is a strategy used by a nations central bank during booming growth periods to slow down the economy and control rising inflation. People can hold any loaned money as cash. Tight Monetary Policy Economics Help.

Source: economicshelp.org

Source: economicshelp.org

A tight monetary policy works effectively to brake inflation but an easy monetary policy is not always as effective in stimulating the economy from recession. Monetary policy affects how much prices are rising called the rate of inflation. During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. Its aim is to reduce the pressure caused by high inflation and to cool the economy. Tight Monetary Policy Economics Help.

Source: present5.com

Source: present5.com

When the government pursued a tight money policy during the Great Depression it caused aggregate demand to decrease because it. Since 2020 the Reserve Bank has put in place a comprehensive set of monetary policy measures to lower funding costs and support the supply of credit. When the government pursued a tight money policy during the Great Depression it caused aggregate demand to decrease because it. High inflation can lead to hyperinflation if it is not controlled. Monetary Policy Regulating Money Supply 2 Types.

Source: economicshelp.org

Source: economicshelp.org

In the real world the actual money multiplier tends to be smaller than 1rr because. The Reserve Bank is responsible for Australias monetary policy. People hold some loaned money as cash. Monetary policy involves setting the interest rate on overnight loans in the money market the cash rate. Tight Monetary Policy Economics Help.

Source: economicshelp.org

Source: economicshelp.org

We also support the Governments other economic aims for growth and employment. We set monetary policy to achieve the Governments target of keeping inflation at 2. It does this with monetary policy. A contractionary monetary policy also called a tight monetary policy reduces the quantity of money and credit below what it otherwise would have been and raises interest rates seeking to hold down inflation. Tight Fiscal Policy Economics Help.

Source: nzier.org.nz

Source: nzier.org.nz

Banks do not loan out all of excess their reserves. The Federal Reserve uses three. Lower the reserve requirement To stimulate the economy the Federal Reserve decides that the amount of money in circulation needs to increase. Since 2020 the Reserve Bank has put in place a comprehensive set of monetary policy measures to lower funding costs and support the supply of credit. Monetary Policy Nzier.

Source: slideplayer.com

Source: slideplayer.com

The Federal Reserve uses three. To control inflation the Fed must use contractionary monetary policy to slow economic growth. The money multiplier will equal 1rr so long as. A tight money policy that is designed to decrease inflation is in conflict with from ECON 224 at American InterContinental University. Macro Economic Policy And Agriculture Fiscal Policy Tools Government Spending Taxation Monetary Policy Tools Discount Rate Open Market Actions Reserve Ppt Download.

Source: rbnz.govt.nz

Source: rbnz.govt.nz

The money multiplier will equal 1rr so long as. Low and stable inflation is good for the UKs economy and it is our main monetary policy aim. Tight or contractionary monetary policy is a course of action undertaken by a central bank such as the Federal Reserve to slow down overheated economic growth to constrict spending in. During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. Monetary Policy And Inflation Reserve Bank Of New Zealand.

Source: rbnz.govt.nz

Source: rbnz.govt.nz

Banks loan out all of their excess reserves. The cost to a household for daily necessities such as. What effect does a tight money policy have on the reserve requirement and the economys money supply. When unemployment drops skilled workers find jobs and. Monetary Policy And Inflation Reserve Bank Of New Zealand.

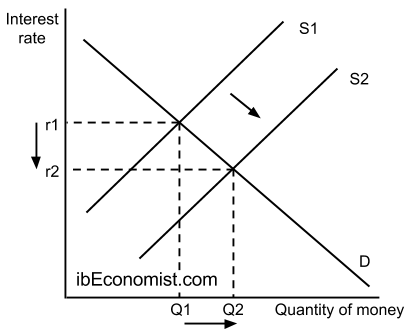

Source: ibeconomist.com

Source: ibeconomist.com

The effect of lower unemployment on inflation mirrors the effect of high employment on labor and product markets. People hold some loaned money as cash. During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. The cost to a household for daily necessities such as. 2 5 Monetary Policy The Ib Economist.

Source: slidetodoc.com

Source: slidetodoc.com

To control inflation the Fed must use contractionary monetary policy to slow economic growth. Contractionary monetary policy is a strategy used by a nations central bank during booming growth periods to slow down the economy and control rising inflation. Japans ineffective easy money policy illustrates the potential inability of monetary policy to bring an economy out of recession. Occurs when Fed tries to decrease money supply by decreasing excess reserves in order to slow spending in the economy during an inflationary period. Monetary Policy Economics Understanding Inflation Definition Of Inflation.

Source: investopedia.com

Source: investopedia.com

What effect does a tight money policy have on the reserve requirement and the economys money supply. Banks do not loan out all of excess their reserves. It is used to overcome an inflationary gap. The Federal Reserve uses three. Tight Monetary Policy Definition.

Source: opentextbc.ca

Source: opentextbc.ca

The Federal Reserve uses three. Banks do not loan out all of excess their reserves. A contractionary monetary policy also called a tight monetary policy reduces the quantity of money and credit below what it otherwise would have been and raises interest rates seeking to hold down inflation. Low and stable inflation is good for the UKs economy and it is our main monetary policy aim. Monetary Policy And Economic Outcomes Principles Of Macroeconomics 2e.

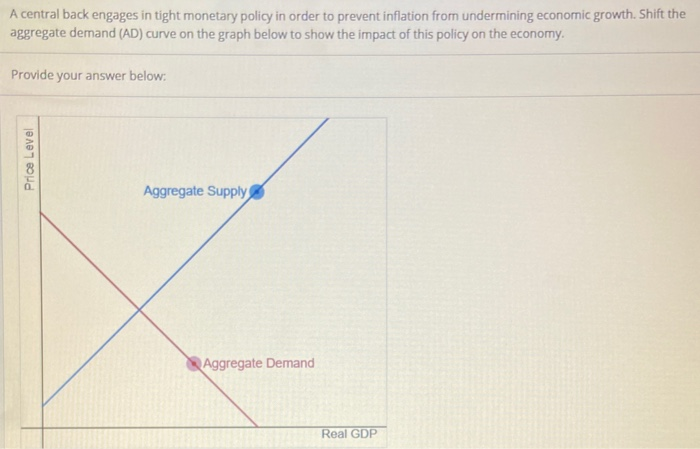

Source: chegg.com

Source: chegg.com

During the 20082009 recession central banks around the world also used quantitative easing to expand the supply of credit. The effect of lower unemployment on inflation mirrors the effect of high employment on labor and product markets. Phillips found that a decrease in the unemployment rate was only achieved by the short-term increase in inflation. We set monetary policy to achieve the Governments target of keeping inflation at 2. Solved A Central Back Engages In Tight Monetary Policy In Chegg Com.