Countrywide and LandSafe deny any wrongdoings detailed in the class action lawsuit. Americas Worst Foreclosure Fails See. Bank of america countrywide home loans settlement.

Bank Of America Countrywide Home Loans Settlement, The deadline to request reimbursement from Countrywide for known identity theft is 90 days after the Court grants final approval of the settlement and any appeals are resolved. Bank of America agreed to pay 335 million to resolve allegations that its Countrywide unit engaged in a widespread pattern of discrimination against qualified African-American and Hispanic. The settlement also provided money for borrowers who lost their homes and to fund local foreclosure prevention programs. The first was a 1665 billion deal between the Charlotte NC-based bank the US.

Financial Calculator Money Tips Money Saving Tips Savings Account From pinterest.com

Financial Calculator Money Tips Money Saving Tips Savings Account From pinterest.com

Payments by Countrywide will be paid on a first-come first-serve basis up to a total of 5 million. Countrywide and LandSafe deny any wrongdoings detailed in the class action lawsuit. As a result Bank of America paid FHA nearly 471 million to settle the Countrywide portion of the consent judgment. Americas Worst Foreclosure Fails See.

Bac home loans which did business as countrywide home loans servicing lp before it was acquired by bank of america in 2008 agreed to the ftc settlement in conjunction with a 25 billion global civil settlement that bank of america and the four other largest us.

Read another article:

Countrywide and LandSafe deny any wrongdoings detailed in the class action lawsuit. Bank of America manages more home loans than any other company so this deal could mark a major shift. Bank of America and its affiliated entities also agreed to a deferred settlement payment to FHA of 850 million. They contend that their mortgage loan appraisals were completely legal and in compliance with USPAP and other regulations. Entered into a Settlement Agreement dated as of June 28 2011 the Settlement Agreement with The Bank of New York Mellon BNY Mellon as trustee the.

Source: id.pinterest.com

Source: id.pinterest.com

Subsidiary has agreed to. Banks reached with the us. Bank of America manages more home loans than any other company so this deal could mark a major shift. Americas Worst Foreclosure Fails See. You Don T Have To Find A Wizard To Get Help With Your Credit Visit Us Today At Www Affordablecreditsolu Credit Solutions Credit Repair Credit Repair Services.

Banks reached with the us. NEW YORK May 7 Reuters - Countrywide Financial Corp the mortgage lender acquired by Bank of America Corp BACN has agreed to. If youre one of the lucky few your savings or a financial windfall will cover the cost of buying your home but if youre among the masses you will need to take. As a result Bank of America paid FHA nearly 471 million to settle the Countrywide portion of the consent judgment. Bank Of America Is Found Liable For Countrywide Mortgage Fraud Los Angeles Times.

Source: nytimes.com

Source: nytimes.com

Banks reached with the us. NEW YORK Reuters - As part of a settlement with state attorneys general that could be worth as much as 86 billion Bank of America Corp BACN said on Monday it. The settlement provides 335 million in compensation for victims of Countrywides discrimination during a period when Countrywide originated millions of residential mortgage loans as one of the nations largest single-family mortgage lenders. Banks reached with the us. 335 Million Settlement On Countrywide Lending Bias The New York Times.

Source: topclassactions.com

Source: topclassactions.com

Bank of Americas mortgage business has lost more than 50 billion since the Charlotte bank bought Countrywide Financial for 25 billion according to an. As a result Bank of America paid FHA nearly 471 million to settle the Countrywide portion of the consent judgment. Bank of America purchased Countrywide in 2008 a decision that has cost the bank an estimated 40 billion in real-estate losses legal expenses and settlements with state and federal agencies the Wall Street Journal recently reported. Bank of america delivers the fastest auto loans and a great deal of information. Bank Of America Force Placed Insurance Settlement Checks Mailed Top Class Actions.

Source: pinterest.com

Source: pinterest.com

Bank of AmericaCountrywide Settlement and Relief Washington and 39 other states announced a landmark agreement in October 2008 in which Bank of America agreed to modify loan terms for Countrywide borrowers. If youre one of the lucky few your savings or a financial windfall will cover the cost of buying your home but if youre among the masses you will need to take. NEW YORK Reuters - As part of a settlement with state attorneys general that could be worth as much as 86 billion Bank of America Corp BACN said on Monday it. NEW YORK May 7 Reuters - Countrywide Financial Corp the mortgage lender acquired by Bank of America Corp BACN has agreed to. Financial Calculator Money Tips Money Saving Tips Savings Account.

Source: issuu.com

Source: issuu.com

Bank of Americas mortgage business has lost more than 50 billion since the Charlotte bank bought Countrywide Financial for 25 billion according to an. Entered into a Settlement Agreement dated as of June 28 2011 the Settlement Agreement with The Bank of New York Mellon BNY Mellon as trustee the. The Countrywide Settlement Agreement requires Bank of America andor Countrywide to pay a total of US850000000000 US85 billion into the Covered Trusts the Settlement Payment. Bank of America and its affiliated entities also agreed to a deferred settlement payment to FHA of 850 million. Technology Affordable Housing By Ait Solutions Issuu.

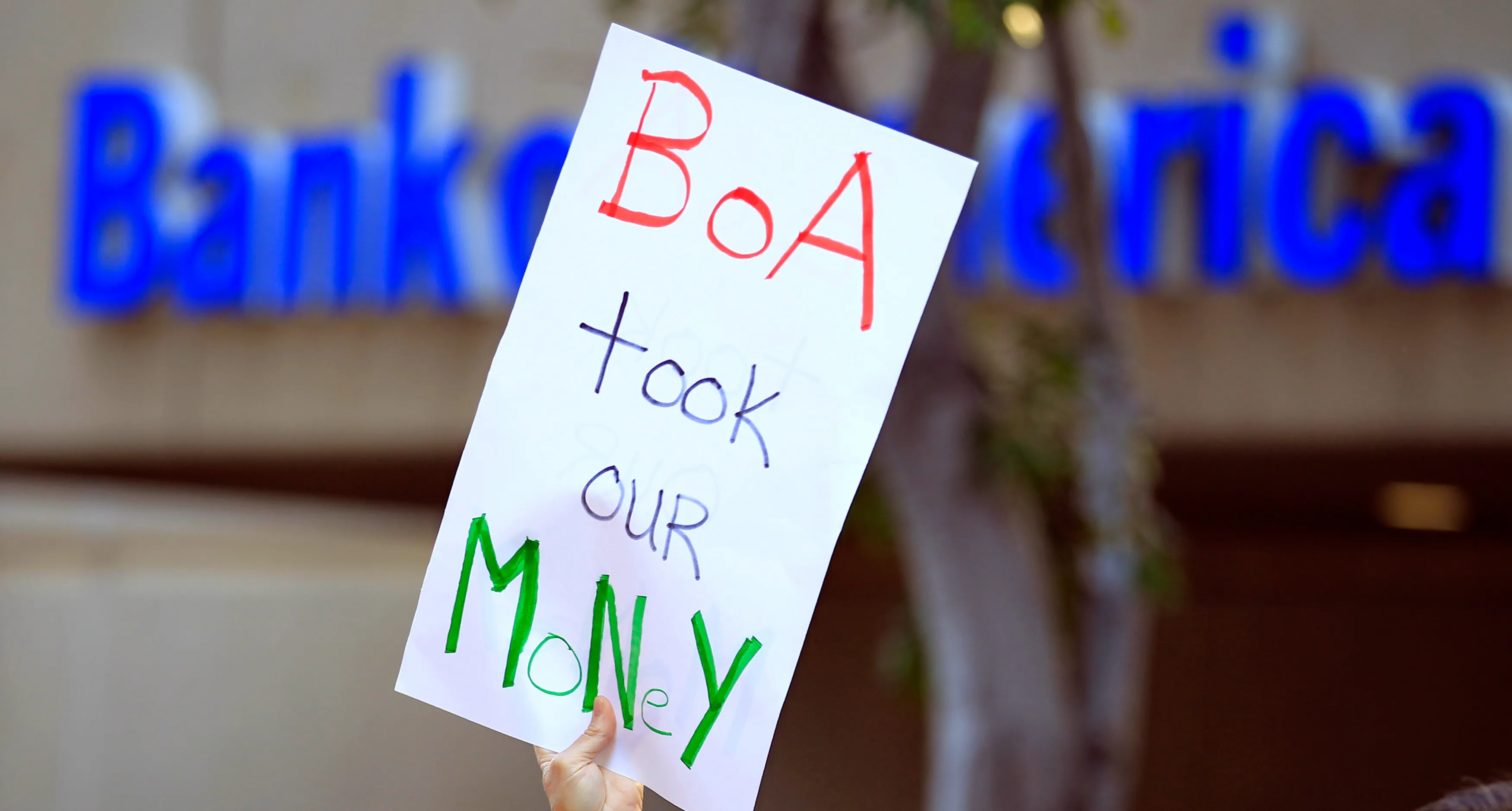

Source: theguardian.com

Source: theguardian.com

Consumers with further questions can contact the settlement administrator by. Department of Justice and a handful of states and federal agencies. Consumers with further questions can contact the settlement administrator by. To comply with the settlement Bank of America set up the Countrywide National Homeownership Retention Program as a vehicle for providing. Bank Of America S Countrywide Found Guilty Of Mortgage Fraud Us Housing And Sub Prime Crisis The Guardian.

Source: topclassactions.com

Source: topclassactions.com

The verdict comes as the government is negotiating a 13 billion settlement with JPMorgan Chase Co to resolve a number of probes and claims arising from its mortgage business including the sale of mortgage bonds. Bank of America purchased Countrywide in 2008 a decision that has cost the bank an estimated 40 billion in real-estate losses legal expenses and settlements with state and federal agencies the Wall Street Journal recently reported. The government continues to investigate banks for conduct related to the financial crisis. Bank of America manages more home loans than any other company so this deal could mark a major shift. Countrywide Settlement Refunds Go Out To Abused Homeowners Top Class Actions.

Source: dw.com

Source: dw.com

The settlement provides 335 million in compensation for victims of Countrywides discrimination during a period when Countrywide originated millions of residential mortgage loans as one of the nations largest single-family mortgage lenders. The Countrywide Settlement Agreement requires Bank of America andor Countrywide to pay a total of US850000000000 US85 billion into the Covered Trusts the Settlement Payment. Entered into a Settlement Agreement dated as of June 28 2011 the Settlement Agreement with The Bank of New York Mellon BNY Mellon as trustee the. Bac home loans which did business as countrywide home loans servicing lp before it was acquired by bank of america in 2008 agreed to the ftc settlement in conjunction with a 25 billion global civil settlement that bank of america and the four other largest us. Financial Crisis Bank Fines Hit Record 10 Years After Market Collapse Business Economy And Finance News From A German Perspective Dw 10 08 2017.

Source: cnbc.com

Source: cnbc.com

The government continues to investigate banks for conduct related to the financial crisis. NEW YORK Reuters - As part of a settlement with state attorneys general that could be worth as much as 86 billion Bank of America Corp BACN said on Monday it. The verdict comes as the government is negotiating a 13 billion settlement with JPMorgan Chase Co to resolve a number of probes and claims arising from its mortgage business including the sale of mortgage bonds. Banks reached with the us. Bank Of America In 16 65b Mortgage Settlement Doj.

Source: marketplace.org

Source: marketplace.org

To comply with the settlement Bank of America set up the Countrywide National Homeownership Retention Program as a vehicle for providing. That will pour 65 million into a. The settlement provides 335 million in compensation for victims of Countrywides discrimination during a period when Countrywide originated millions of residential mortgage loans as one of the nations largest single-family mortgage lenders. Bank of america delivers the fastest auto loans and a great deal of information. Following The Money What Happened To A Nearly 17 Billion Bank Settlement Marketplace.

Source: nbcnews.com

Source: nbcnews.com

The settlement released Bank of. The settlement provides 335 million in compensation for victims of Countrywides discrimination during a period when Countrywide originated millions of residential mortgage loans as one of the nations largest single-family mortgage lenders. The scale of this is very unprecedented said. The deadline to request reimbursement from Countrywide for known identity theft is 90 days after the Court grants final approval of the settlement and any appeals are resolved. Bank Of America Loses Fraud Trial Over Shoddy Mortgages.

Source: in.pinterest.com

Source: in.pinterest.com

The settlement released Bank of. Department of Justice and a handful of states and federal agencies. They contend that their mortgage loan appraisals were completely legal and in compliance with USPAP and other regulations. Department of justice and state attorneys general to. Five Sound Reasons For Investing In Real Estate Mortgage Payment Home Financing Second Mortgage.

Source: money.com

Source: money.com

As a result Bank of America paid FHA nearly 471 million to settle the Countrywide portion of the consent judgment. Subsidiary has agreed to. The scale of this is very unprecedented said. By Jonathan Stempel. What Bank Of America Did To Warrant A 17 Billion Penalty Money.

Source: it.pinterest.com

Source: it.pinterest.com

Subsidiary has agreed to. Bank of AmericaCountrywide Settlement and Relief Washington and 39 other states announced a landmark agreement in October 2008 in which Bank of America agreed to modify loan terms for Countrywide borrowers. Bank of America purchased Countrywide in 2008 a decision that has cost the bank an estimated 40 billion in real-estate losses legal expenses and settlements with state and federal agencies the Wall Street Journal recently reported. The state of California has reached a settlement in a predatory lending lawsuit against former executives at Countrywide Financial Corp. Http Seobeaver Ca Seo Toronto Seo Toronto If You Are In The Toronto Area And Need High Quality Seo Services Look No Furth Places To Visit Old Fort Places.