If youre over 65 and own your house home reversion lets you unlock tax-free cash for a more comfortable retirement by selling a share of your home. Most people choose the home reversion plan because it provides them with the option of being able to leave an inheritance. Aviva home reversion plan.

Aviva Home Reversion Plan, We lobbied the Treasury back in 2002 on this issue and called on them to introduce full regulation of both Lifetime Mortgages and Home Reversion Plans. - 6 - v2018 Aviva. As well as receiving an initial lump sum of 10000 or more your client can set up a cash reserve of 5000 or more from which they can draw money when they need it. In other words you borrow an initial amount and then set up a cash reserve to draw money from.

Equity Release From Aviva Youtube From youtube.com

Equity Release From Aviva Youtube From youtube.com

Eligibility criteria for home reversion plans to be eligible for a home reversion plan you will usually need to own a property valued at 80000 or more and be at least 55 years old. Our Lifestyle Flexible Option offers your clients freedom and cost-effectiveness. Home reversion is different because it is a sale of all or part of your home. Aviva will accept new business applications for its home reversion plan which is funded by Grainger plc owner of home reversion specialist Bridgewater Equity Release until 10 February.

Aviva is the rebranded name of norwich union and is one of the longest serving providers of equity release plans today.

Read another article:

1D Comparing lifetime mortgages with home reversion plans A Home reversion plan is not a mortgage or even any type of loan. Aviva Home Reversion Plan Heres how to sell a house with a reverse mortgage. Luna Howe Released 50000 Joseph was a returning client whom had taken out a Papilio mortgage in the past and wanted to re-broke it following Avivas slash in interest rates. In other words you borrow an initial amount and then set up a cash reserve to draw money from. By selling a share of your property you become a co-owner but continue to enjoy the right to live in it for the rest of your life.

![]() Source: vimeo.com

Source: vimeo.com

This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. People who want to plan for their retirement can find the calculator useful as they plan for their retirement day. Our Lifestyle Flexible Option offers your clients freedom and cost-effectiveness. If you decide to go ahead you can complete your application form with your financial adviser. Aviva Tv Ad Equity Release On Vimeo.

Source: aviva.co.uk

Source: aviva.co.uk

Most people choose the home reversion plan because it provides them with the option of being able to leave an inheritance. This could be more cost-effective than a single lump-sum loan as theyll only pay interest on. Its often found to encounter individuals looking for home reversion plans monthly payment lifetime the mortgage or home reversion schemes however Key Solutions like Legal General are eager to see paperwork to show your circumstances in the form of pension. Saga home reversion schemes Interest Only Lifetime Mortgages Aviva Hard to mortgage home variants can include poorly maintained at the time of the valuation inspection properties where letting arrangement where the tenancy agreement is not appropriate right to buy properties in Scotland leasehold properties with the exception of flats and maisonettes and properties. What Is Equity Release How Lifetime Mortgages Work Aviva.

Source: sovereignboss.co.uk

Source: sovereignboss.co.uk

How does a home reversion plan work. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. In other words you borrow an initial amount and then set up a cash reserve to draw money from. This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. Aviva Equity Release Review In Dec 2021 Sovereignboss.

Source: mortgagesolutions.co.uk

Source: mortgagesolutions.co.uk

You may need to pay a brokers fee and you could have higher rates to pay with some plans. In other words you borrow an initial amount and then set up a cash reserve to draw money from. Aviva Flexible Plan The Lifetime Lump Sum Max Plan enables you to unlock a one-off cash lump sum starting at 15000. People who want to plan for their retirement can find the calculator useful as they plan for their retirement day. Aviva To Give New Equity Release Borrowers Choice Of Fixed Or Gilt Based Ercs Mortgage Solutions.

Source: ftadviser.com

Source: ftadviser.com

Reversion provider buys all or part of a qualifying interest in land. Aviva is the rebranded name of norwich union and is one of the longest serving providers of equity release plans today. Aviva will accept new business applications for its home reversion plan which is funded by Grainger plc owner of home reversion specialist Bridgewater Equity Release until 10 February. Home reversion plans were much more popular when the only alternative in the equity release. Aviva Introduces Lower Minimum Drawdown For Equity Release Ftadviser Com.

Source: aviva.co.uk

Source: aviva.co.uk

What is a home reversion plan. Aviva will accept new business applications for its home reversion plan which is funded by Grainger plc owner of home reversion specialist Bridgewater Equity Release until 10 February. Do Aviva do Equity Release. Owner sells the property to the reversion provider and becomes a tenant. Equity Release Calculator Aviva.

Source: ftadviser.com

Source: ftadviser.com

We compare UK Equity Release Providers. Simple business plan for home business startup one of the first things budding home business owners are encouraged to do is write a business plan. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. People who want to plan for their retirement can find the calculator useful as they plan for their retirement day. Aviva Appoints Equity Release Md As Neilson Moves To New Role Ftadviser Com.

Source: yourtime.co.uk

Source: yourtime.co.uk

This could be due to a variety of factors not least because newer more flexible equity release solutions such as interest only lifetime mortgages are now available. The Home Reversion Plan is available in England and Wales and is not regulated by the Financial Services Authority. 3A1 Home reversion plans It is an arrangement that includes the following characteristics. Well then arrange an independent valuation of your home and confirm exactly how much money you can release provided it meets our requirements. Aviva Lifeitme Mortgage Your Time Equity Release Experts.

Source: aviva.com

Source: aviva.com

Home reversion plans were much more popular when the only alternative in the equity release. Public 5I Home reversion plans HRP An HRP has the same purpose as a lifetime mortgage but achieves this in a different way. Our Lifestyle Flexible Option offers your clients freedom and cost-effectiveness. If youre over 65 and own your house home reversion lets you unlock tax-free cash for a more comfortable retirement by selling a share of your home. Aviva Announces New Flexible Repayment Options To Equity Release Aviva Plc.

Source: aviva.co.uk

Source: aviva.co.uk

Aviva Capital Lump Sum Equity Release. Luna Howe Released 50000 Joseph was a returning client whom had taken out a Papilio mortgage in the past and wanted to re-broke it following Avivas slash in interest rates. Yes Aviva Pensioner Mortgages are 215 MER. Howe initially wanted more information on the Home Reversion plan but once we established her needs it become apparent a lifetime mortgage scheme was more ideal because. Manage Your Equity Release Plan Aviva.

Source: moneyrelease.co.uk

Source: moneyrelease.co.uk

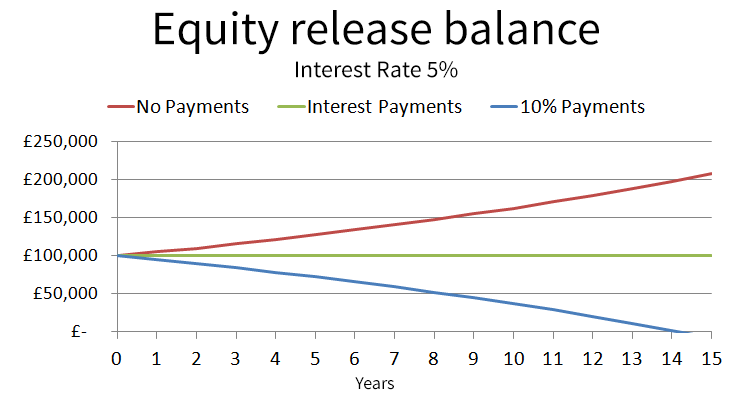

UK Equity Release Scheme Lenders. This could be more cost-effective than a single lump-sum loan as theyll only pay interest on. The Home Reversion Plan is available in England and Wales and is not regulated by the Financial Services Authority. Reversion provider buys all or part of a qualifying interest in land. Can I Repay My Equity Release With Examples Video.

Source: timhales.co.uk

Source: timhales.co.uk

Do Aviva do Equity Release. Home reversion plans were much more popular when the only alternative in the equity release. Howe initially wanted more information on the Home Reversion plan but once we established her needs it become apparent a lifetime mortgage scheme was more ideal because. Well then arrange an independent valuation of your home and confirm exactly how much money you can release provided it meets our requirements. Put Your Plans Into Action Tim Hales.

Source: timhales.co.uk

Source: timhales.co.uk

Home reversion plans definition The FCA definition of a home reversion plan is provided in MCOB. Building your own home is a challenging thrilling rewarding and sometimes frustrating process. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. The Norwich Union Home Reversion Plan is offered by Norwich Union Equity Release Limited on behalf of Grainger Trust plc and their subsidiaries the UKs largest residential property investor quoted on the stock exchange. Put Your Plans Into Action Tim Hales.

Source: moneyrelease.co.uk

Source: moneyrelease.co.uk

What is a home reversion plan. Aviva will accept new business applications for its home reversion plan which is funded by Grainger plc owner of home reversion specialist Bridgewater Equity Release until 10 February. Discuss your plans and options with your family and decide whether a lifetime mortgage is right for you. Aviva has been providing home reversion plans as well as lifetime mortgages to homeowner over the years via Grainger PLC. Are Aviva Equity Release Plans Any Good My Honest Review.

Source: frequentfinance.co.uk

Source: frequentfinance.co.uk

Aviva Capital Lump Sum Equity Release. Home reversion will never enable the customer to raise the full value of the property as the finance provider has to balance reward with risk. Most people choose the home reversion plan because it provides them with the option of being able to leave an inheritance. Aviva will accept new business applications for its home reversion plan which is funded by Grainger plc owner of home reversion specialist Bridgewater Equity Release until 10 February. A 1 96 Mer Aviva Equity Release Interest Only Mortgage 2021.