You are in the right place. Higher credit scores can open the doors to some very attractive perks. Average credit score for first time home buyers.

Average Credit Score For First Time Home Buyers, Americans credit scores jumped in 2020. Buyers often assume they will need a minimum 700 FICO credit score. Youve heard it time and time again that a solid credit score is vital to securing a good mortgage rate or any mortgage at all. Expand your knowledge of home goods.

What Credit Score Is Needed To Buy A Car Credit Repair Business Credit Score Credit Repair From br.pinterest.com

What Credit Score Is Needed To Buy A Car Credit Repair Business Credit Score Credit Repair From br.pinterest.com

A fair credit score 650 to 699. Experian data shows 58 per cent of those aged 25-44 who have an average annual household. But there is still room for improvement. The credit score needed for first time home buyers is of the following range.

Here you can find everything about Good Credit Score For First Time Home Buyer.

Read another article:

Borrowers need just a 3 down payment. Average Credit Scores for Home Buyers Are Rising. A minimum of 580 is needed to make the minimum down payment of 35. Improving National home buyer First Time Home Buyer 2018 First Time Home Buyer Pre Qualification The steps to buy a house might seem complicated at firstparticularly if youre a first-time home buyer dipping. Here you can find everything about Good Credit Score For First Time Home Buyer.

Source: br.pinterest.com

Source: br.pinterest.com

VA Loan 620 credit score. Mortgage reforms that were put in place following the housing market crisis of 2007 and 2008 make it more difficult for consumers with low credit scores to qualify for home loans. Score First Buyer Credit Average Time Home Gobuddyco First-home buyers bank on a boost to their credit score First-time home buyers are benefiting from the new credit score system as well as the falling property. Thanks to a new FHA policy lenders appear to have started reducing their FHA minimum credit score requirements starting in 2017 opening homeownership to thousands more home buyers. Infographic How Your Credit Score Impacts Your Home Buy Deadlinenews Com Real Estate News Home Buying Process Home Buying Tips Home Buying.

Source: pinterest.com

Source: pinterest.com

Maximum tax credit of 15000. VA Loan 620 credit score. Want to know more about Good Credit Score For First Time Home Buyer. Experian data shows 58 per cent of those aged 25-44 who have an average annual household. The Average Credit Score To Qualify For A Mortgage Is Now Very High Average Credit Score Credit Score Scores.

Source: ar.pinterest.com

Source: ar.pinterest.com

Income cannot exceed 100 of the area median income AMI. Generally most mortgage loans require a credit score of 620 or higher. A credit score lower than 650 is deemed poor meaning your credit. First-Time Homebuyer Requirements Credit A minimum 620 credit score is required for a mortgage except FHA and VA loans which you can be approved with a 580 credit score. Pin Auf Board For First Time Buyers.

Source: pinterest.com

Source: pinterest.com

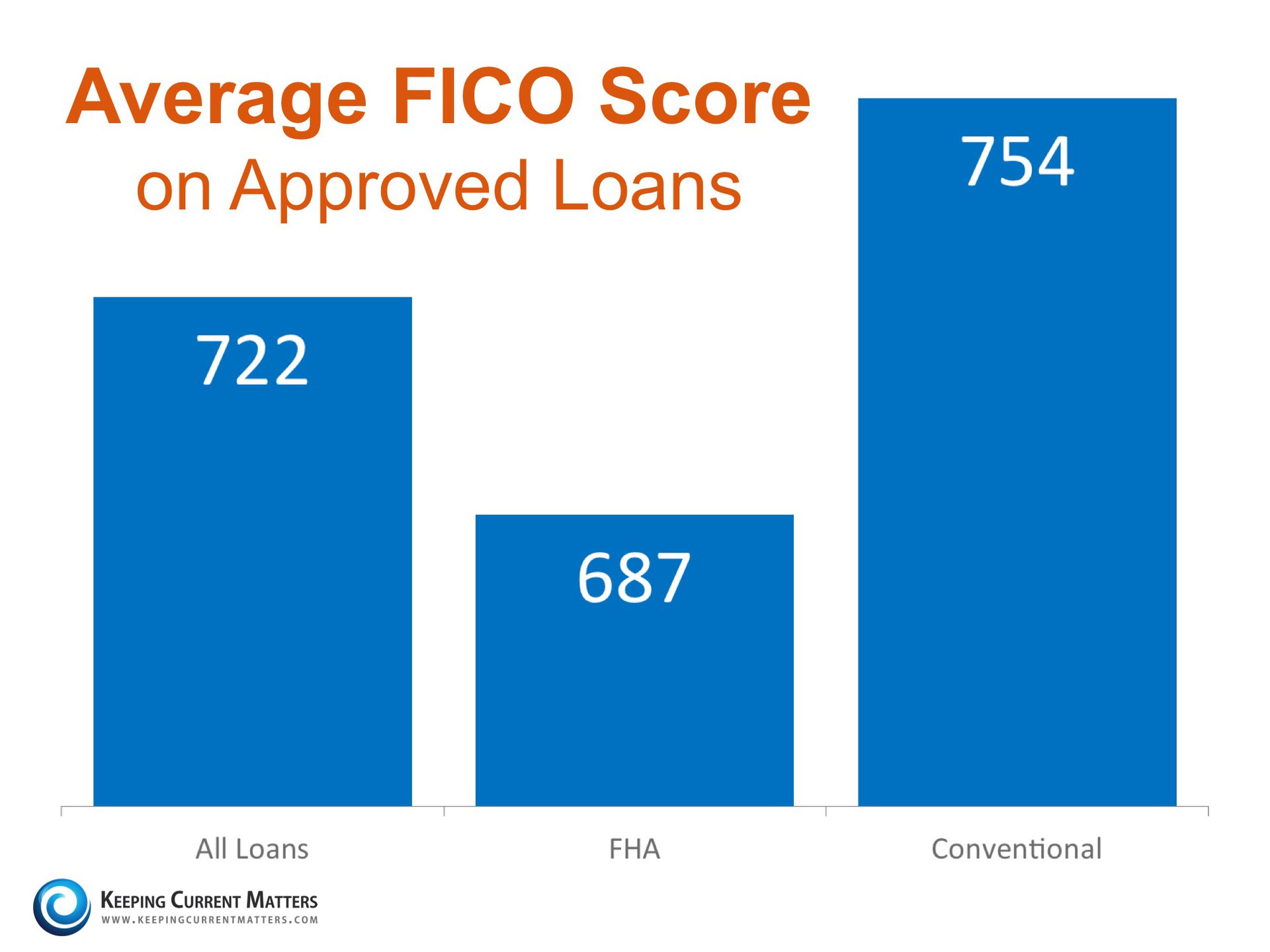

Borrowers need just a 3 down payment. Generally most mortgage loans require a credit score of 620 or higher. Average Credit Score for First-Time Home Buyers in 2017. You are in the right place. What You Really Need To Qualify For A Mortgage Keeping Current Matters Fico Score Scores Mortgage.

Source: pinterest.com

Source: pinterest.com

Maximum tax credit of 15000. Equifax Experian and TransUnion all with slightly different methods to determine your credit score. In order to be USDA-approved borrowers must have a credit score of 620 or better. Generally most mortgage loans require a credit score of 620 or higher. Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic.

Source: pinterest.com

Source: pinterest.com

A minimum of 580 is needed to make the minimum down payment of 35. Average Credit Score for First-Time Home Buyers in 2017. There are three credit bureaus. Score First Buyer Credit Average Time Home Gobuddyco First-home buyers bank on a boost to their credit score First-time home buyers are benefiting from the new credit score system as well as the falling property. Credit Scoring Algorithm Myths Busted What Is Credit Score Improve Your Credit Score Credit Score.

Source: ro.pinterest.com

Source: ro.pinterest.com

Generally most mortgage loans require a credit score of 620 or higher. A credit score lower than 650 is deemed poor meaning your credit. A good credit score is from 700 to 749. VA Loan 620 credit score. 2 Charts That Show The Truth About Home Affordability What Is Credit Score Credit Score Home Ownership.

Source: es.pinterest.com

Source: es.pinterest.com

Income cannot exceed 100 of the area median income AMI. Borrowers need just a 3 down payment. First Time Home Buyer Credit Qualifications Pocketsense Generally people buying a home for the first time must have a a credit score of 620 or higher for loan approval with scores of 750 or higher needed for the lowest interest rates. The credit scores for first time home buyers ranged from 662 to 730 depending upon their state of residence. Do I Need Perfect Credit To Buy A Home Infographic Blog Boca Raton Fort Lauderdale Homes Home Buying Home Buying Tips Real Estate Infographic.

Source: pinterest.com

Source: pinterest.com

First Time Home Buyer Credit Qualifications Pocketsense Generally people buying a home for the first time must have a a credit score of 620 or higher for loan approval with scores of 750 or higher needed for the lowest interest rates. A minimum of 580 is needed to make the minimum down payment of 35. FHA 203K Loan 620 credit score. Experian data shows 58 per cent of those aged 25-44 who have an average annual household. Regranned From Makingdealsinheels 76 Mortgagetipmonday When Looking To Purchase A Home Your Credit Score Is A Credit Score Loans For Bad Credit Credits.

Source: pinterest.com

Source: pinterest.com

Credit scores are maintained by the national credit bureaus and include debt like credit cards auto loans or student loans. Good Credit Score For First Time Home Buyer. This national improvement in credit scores could potentially signify some exciting changes especially for first-time home buyers with credit scores at or above the national average. A score of 740 or above is generally considered very good but you dont need that score or above to buy a home. Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval Louisville Kentucky Mortgage Loans No Credit Loans Bad Credit Mortgage Credit Score.

Source: pinterest.com

Source: pinterest.com

FICO credit scores range from 350-850 points with higher scores indicating less credit risk for lenders. Average Credit Score for First-Time Home Buyers in 2017. There are three credit bureaus. The HomeReady and Home Possible Loan programs are mortgage loans for low-income created by Fannie Mae and Freddie Mac for low-income first-time homebuyers with a 620 or higher credit score. Credit Score Information For Kentucky Home Buyers Credit Score Mortgage Loans Fha Loans.

Source: fi.pinterest.com

Source: fi.pinterest.com

The HomeReady and Home Possible Loan programs are mortgage loans for low-income created by Fannie Mae and Freddie Mac for low-income first-time homebuyers with a 620 or higher credit score. FHA 203K Loan 620 credit score. Average Credit Score to Buy a House in 2020 Credit Karma. The credit scores for first time home buyers ranged from 662 to 730 depending upon their state of residence. Pin Auf Credit Repair.

Source: pinterest.com

Source: pinterest.com

Chapters include budgeting Home prices rising Interest rate. FICO credit scores range from 350-850 points with higher scores indicating less credit risk for lenders. Score First Buyer Credit Average Time Home Gobuddyco First-home buyers bank on a boost to their credit score First-time home buyers are benefiting from the new credit score system as well as the falling property. The HomeReady and Home Possible Loan programs are mortgage loans for low-income created by Fannie Mae and Freddie Mac for low-income first-time homebuyers with a 620 or higher credit score. 404 Page Not Found Magnifymoney Credit Score Scores Mortgage Tips.

Source: pinterest.com

Source: pinterest.com

Average Credit Score for First-Time Home Buyers in 2017. What are todays mortgage rates. Score and what number is best to buy a home. Borrowers need just a 3 down payment. How To Get An 800 Credit Score Before You Turn 25 Credit Score Better Money Habits How To Get.

Source: ru.pinterest.com

Source: ru.pinterest.com

A credit score lower than 650 is deemed poor meaning your credit. What are todays mortgage rates. Experian data shows 58 per cent of those aged 25-44 who have an average annual household. Score First Buyer Credit Average Time Home Gobuddyco First-home buyers bank on a boost to their credit score First-time home buyers are benefiting from the new credit score system as well as the falling property. Workout Your Credit And Budget For Your Home Loan Before Shopping Mortgage Mortgageloan Financialplanning Financ Mortgage Tips Home Loans Online Mortgage.