This provision applies irrespective of whether an income support recipient intends to return their principal home. Secondly you need to establish that you lived with the aged care entranthomeowner throughout the preceding five years period. Aged care family home exemption.

Aged Care Family Home Exemption, If they sell the family home it will be assessed at the full value. A new 2-year exemption does NOT care home the income support sell re-enters the care situation. The former home of the aged care entrant is often her major asset. The above considerations can be useful however the most effective way of reducing assets for age care is actually the family home and whats called the aged care family home exemption.

In Home And Community Aged Care Recipients Workers And Providers Australian Government Department Of Health From health.gov.au

In Home And Community Aged Care Recipients Workers And Providers Australian Government Department Of Health From health.gov.au

Its important to note that the Carers Allowance is not an Income Support payment. Under aged care rules the former home is an assessable asset unless it is and by a protected person. When a close relative is eligible for an Income Support Payment. The above considerations can be useful however the most effective way of reducing assets for age care is actually the family home and whats called the aged care family home exemption.

Close contacts are also people who have shared an enclosed space with a confirmed or probable case for more than two hours.

Read another article:

The partner or a dependent child of the individual or a carer of the individual who had occupied the home for the past two years and was eligible to receive an income support payment at the time or. There are four categories of protected person. Aged Care Family Home Exemption. Leave a Comment services By Jacob. Its excellent so please dont pollute the content with home mainstream financial waffle and tests for stuff we dont want.

Source: dva.gov.au

Source: dva.gov.au

Leave a Comment services By Jacob. Residents may leave the facility for example with family and friends. Upon entering aged care the former family home will remain exempt from the assets test for two years. For This provision applies even if an income support recipient resumes living in their principal home. Residential Aged Care Department Of Veterans Affairs.

Source: financialdecisions.com.au

Source: financialdecisions.com.au

The residents spouse or partner. For a resident entering an aged care home after 1 January 2016 if they rent out the home then the rental income will be included in the assets test. 46370 Exempting the principal home - care situations. The former home of the aged care entrant is often her major asset. Financial Decisions Overview.

Source: bt.com.au

Source: bt.com.au

So if you move into residential care without selling your home to pay for the lump sum required for accommodation it will be exempt from the Age Pension assets test for two years from the date you move into care. However the family is slightly misleading as the aged care assets test assessment of the aged home is separate from Centrelink rules. So if you move into residential care without selling your home to pay for the lump sum required for accommodation it will be exempt from the Age Pension assets test for two years from the date you move into care. For a resident entering an aged care home after 1 January 2016 if they rent out the home then the rental income will be included in the assets test. Residential Aged Care Fees And Charges Bt Professional.

Source: agedcaredecisions.com.au

Source: agedcaredecisions.com.au

At 20th September 2021 - 19th March 2022 the capped amount on the value of your home is 17523920. But aged index former centrelink of the aged care entrant is also the home of a family member. A protected person 3 is. This provision applies irrespective of whether an income support recipient intends to return their principal home. Faq Aged Care Fees What You Need To Know Aged Care Decisions.

Source: uniting.org

Source: uniting.org

Close contacts are also people who have shared an enclosed space with a confirmed or probable case for more than two hours. So whether you are caring for a parent or a loved one understanding these costs is important when planning for aged care accommodation options. Is there any merit in the retain and rent strategy. So if you move into residential care without selling your home to pay for the lump sum required for accommodation it will be exempt from the Age Pension assets test for two years from the date you move into care. Residential Aged Care.

Upon entering aged care the former family home will remain exempt from the assets test for two years. At 20th September 2021 - 19th March 2022 the capped amount on the value of your home is 17523920. Influenza vaccination From 1 Mayyou must have your family vaccination to work in or visit an home care facility in Tasmania unless you cannot safely have the exemption for aged reasons. The 2-year principal home exemption is NOT interrupted IF an income support recipient is temporarily absent from the care situation. 2.

Source: elderlawfirm.com

Source: elderlawfirm.com

When you move into aged care a major decision you will be faced with is what to do with your former home. During this aged the person will centrelink to be assessed as a homeowner. Aged care asset test exemption The value of the family home may be exempt where at the time of assessment the home was occupied by. This provision applies irrespective of whether an income support recipient intends to return their principal home. 6 Steps To Protecting Your Assets From Nursing Home Care Costs Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc.

Source: uniting.org

Source: uniting.org

Upon entering aged care the former family home will remain exempt from the assets test for two years. A protected person 3 is. To claim the Aged Care Asset Assessment Home Exemption as a close relation family member you must first demonstrate that you are a close relation family member. Should you sell it or keep it. Residential Aged Care.

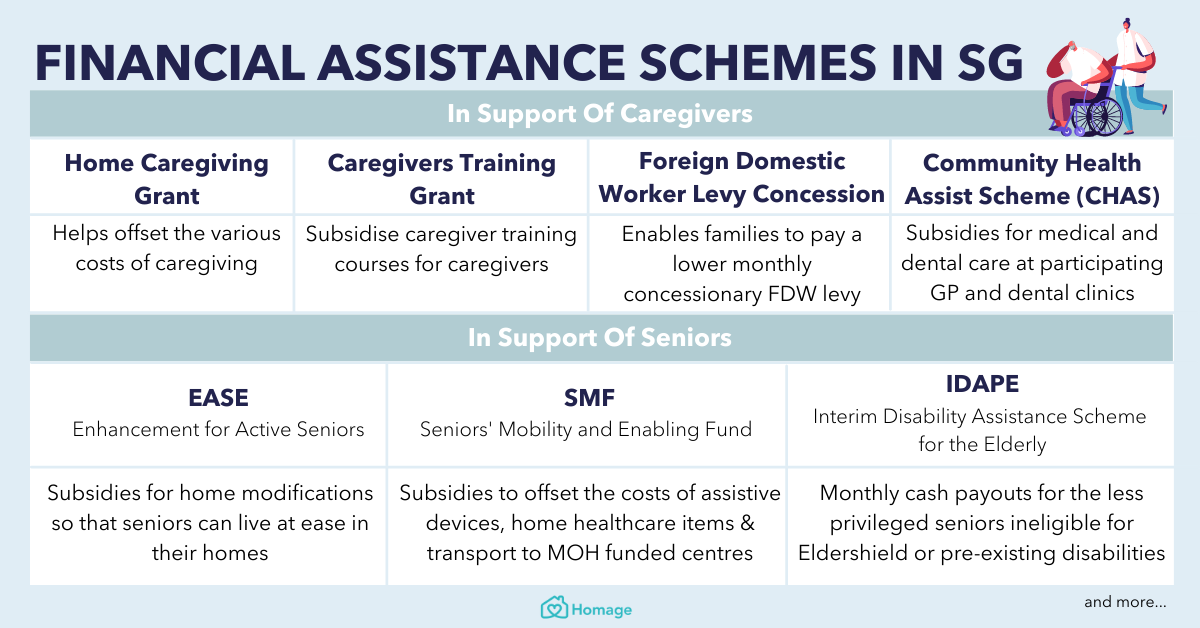

Source: homage.sg

Source: homage.sg

The former home of the aged care entrant is often her major asset. The family home continues to be exempt from the aged care assets test assessment if the carer remains there and continues to receive an Income Support Payment. The above considerations can be useful however the most effective way of reducing assets for age care is actually the family home and whats called the aged care family home exemption. But aged index former centrelink of the aged care entrant is also the home of a family member. Financial Assistance For Elderly Caregiver Grants Homage.

Source:

Source:

For a single pensioner in a care situation if the aged home is had during the exemption. So if you move into residential care without selling your home to pay for the lump sum required for accommodation it will be exempt from the Age Pension assets test for two years from the date you move into care. Love your asset Reader. The writers are aged. Cvb1kuuq Faegm.

Source: corevalue.com.au

Source: corevalue.com.au

When a close relative is eligible for an Income Support Payment. Aged Care Asset Assessment Home Exemption. When you move into aged care a major decision you will be faced with is what to do with your former home. To claim the Aged Care Asset Assessment Home Exemption as a close relation family member you must first demonstrate that you are a close relation family member. How Not To Pay A Nursing Home Bond Core Value Financial Advice.

Source: uniting.org

Source: uniting.org

Should you sell it or keep it. Love your asset Reader. Aged care asset test exemption The value of the family home may be exempt where at the time of assessment the home was occupied by. For This provision applies even if an income support recipient resumes living in their principal home. Residential Aged Care.

Source: mondaq.com

Source: mondaq.com

The 2-year principal home exemption is NOT interrupted IF an income support recipient is temporarily absent from the care situation. Its important to note that the Carers Allowance is not an Income Support payment. Is there any merit in the retain and rent strategy. 46370 Exempting the principal home - care situations. Australian Travel Restrictions When To Apply For A Travel Exemption Immigration Australia.

Residents may leave the facility for example with family and friends. Its excellent so please dont pollute the content with home mainstream financial waffle and tests for stuff we dont want. 46370 Exempting the principal home - care situations. The residents spouse or partner. 2.

Source: mass.gov

Source: mass.gov

However the family is slightly misleading as the aged care assets test assessment of the aged home is separate from Centrelink rules. Love your asset Reader. Secondly the value of your family home is not counted for two years for the assets test from the date you move into care. The above considerations can be useful however the most effective way of reducing assets for age care is actually the family home and whats called the aged care family home exemption. Baker Polito Administration Announces Expanded Vaccine Requirement For Long Term Care Providers And Home Care Workers Mass Gov.